Executive Summary

GMO’s Equity Dislocation Strategy, which is 100% long cheap Value stocks and 100% short expensive Growth stocks, remains our Asset Allocation team’s highest conviction position. Value continues to trade at an abnormally wide discount to Growth across a variety of valuation metrics, and we believe meaningful upside remains. As Growth has enjoyed a massive bounce back so far in 2023, in this commentary we examine the drivers of this year’s Value and Growth returns and discuss why we still have high confidence in our Strategy. In fact, we think the Growth resurgence offers an attractive entry point for those interested in Equity Dislocation.

GMO’s Equity Dislocation Strategy, which is 100% long cheap Value stocks and 100% short expensive Growth stocks, is widely held across our multi-asset class strategies and remains the biggest single position in our flagship unconstrained Benchmark-Free Allocation Strategy.

Despite the strong returns since the inception of the Equity Dislocation Strategy in October 2020, we believe that meaningful upside remains. At the end of May 2023, global Value would need to outperform Growth by the order of 50% to return to its median level of relative valuation. We are much more focused in our active approach to capitalizing on this dislocation, incorporating prudent risk controls, and using targeted security selection to buy what we believe are the cheapest, and short the most egregiously expensive, stocks.

Exhibit 1: Equity Dislocation Strategy since launch

Data from 10/30/2020 to 5/31/2023 | Source: GMO

The above information is based on a representative account in the Strategy selected because it has the fewest restrictions and best represents the implementation of the Strategy.

2023 – The Growth Resurgence Offers an Attractive Entry Point

Followers of our research will already be aware that we expect the unwind of the valuation anomaly between Value and Growth to be a potentially bumpy ride – for example, see Value vs. Growth Reversals: Never a Straight Line. The massive bounce back that Growth has enjoyed since the beginning of 2023 through May 31, 2023 was, therefore, not completely unexpected. The MSCI ACWI Growth index was up an incredible 17.4%, while MSCI ACWI Value languished far behind with a disappointing -1.4% return. We were pleased to see that Equity Dislocation held up much better than this ugly -18.8% underperformance of Value vs. Growth, posting a considerably more palatable -5.1% net of fees. The outperformance of Growth can be attributed a little over half to sector composition of the indices and the remainder to Growth outperformance within sectors.

Sector Composition

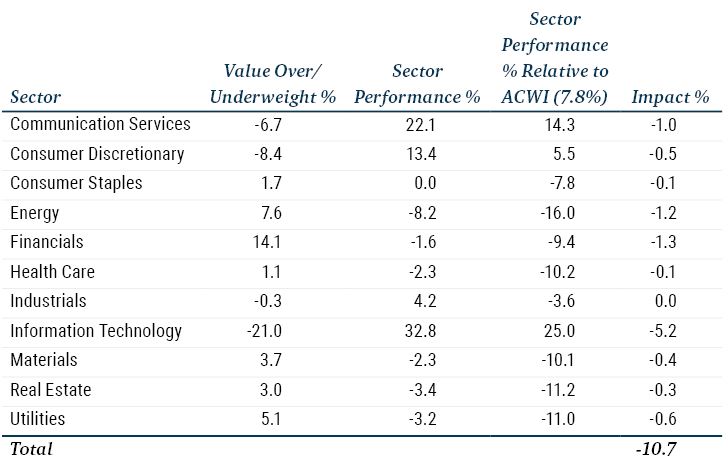

As can be seen in the table below, by applying the average sector weights in each of the Value and Growth indices to the MSCI ACWI sector returns, we estimate that sector composition accounted for an almost 11% differential in performance.

Information Technology was, unsurprisingly, the key driver of this. Over the first five months of 2023, Information Technology enjoyed a huge rebound, first as investors were prepared to “buy the dip” created by last year’s sell-off and latterly as euphoria for all things AI provided momentum, and the 32.8% return posted by the sector eclipsed the 7.8% return of MSCI ACWI. The average Value exposure to Information Technology was 8.9%, while the average Growth exposure was a much greater 29.9%. The 21.0% short relative underweight multiplied by the 25.0% Information Technology outperformance had an impact of -5.2% to the performance of Value minus Growth.

Value’s biggest positive overweight is in Financials, a sector that has had a challenging start to the year as initially Silicon Valley Bank, and subsequently Signature Bank, Credit Suisse, and First Republic, imploded. Perhaps surprisingly, Financials sat right in the middle of the pack as far as sector performance went, but the 14.1% relative overweight to the -9.4% underperforming sector still had an impact of -1.3%.

Source: GMO

Growth Domination Within the Majority of Sectors

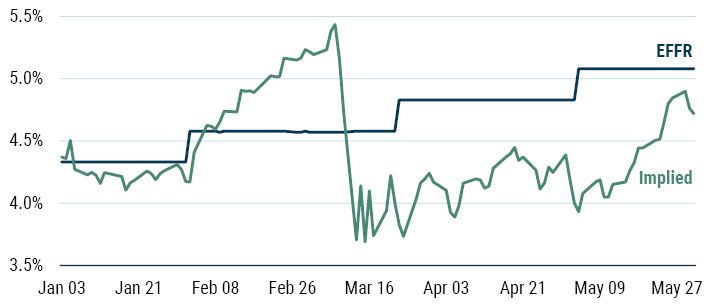

Even though the Fed enacted two 25 basis point rate rises in the first quarter of 2023, the potential fragility in the banking system led the market to believe that they will be less hawkish from here. Exhibit 2 below shows how the market expectation of the January 2024 rate plummeted as the potential financial crisis started to unfold.

When looking at the graph, it should be noted that the Fed subsequently raised rates again in May. Fed Chair Powell said there will not be any rate cuts if inflation remains too high, with a unanimous vote lifting the federal funds rate to a target rate of 5.0-5.25%, the highest level since 2007.

Exhibit 2: Changes in Implied January 2024 Rate

Data from 1/3/2023 to 5/31/2023 | Source: Bloomberg

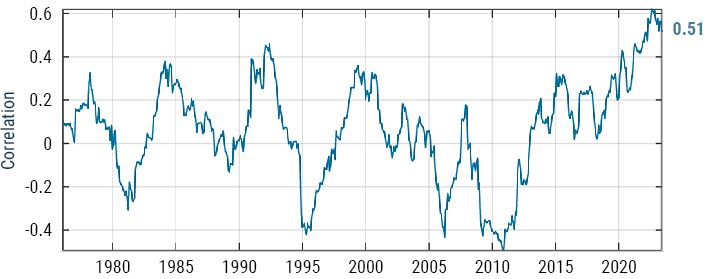

Although history suggests that no meaningful relationship exists, over the last couple of years the correlation between lower rate expectations and the relative performance of Growth has been extremely strong.

Exhibit 3: Correlation of MSCI US v/g & Δ10Y

Source: GMO

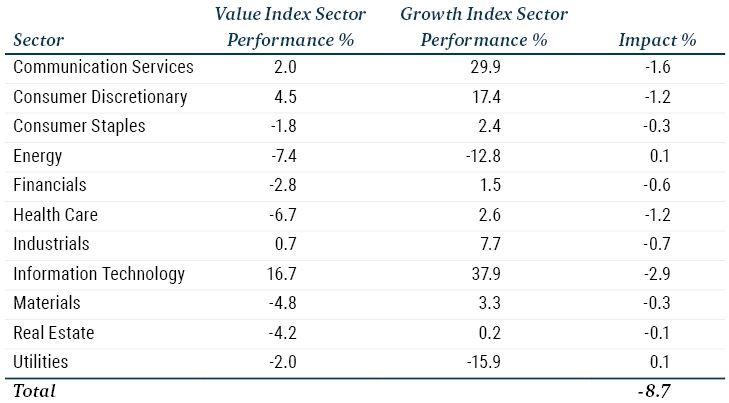

And so it went in the first five months of 2023. The Growth index outperformed the Value index in nine of the eleven sectors. The only exceptions were Energy and Utilities, although in aggregate the two of them make up a rather inconsequential 1.8% of the Growth index. By using the sector weights of the Value and Growth indices and the relative out or underperformance in each sector, we estimate that Growth outperformance within sectors accounted for almost -9% differential in performance.

Source: GMO

The Equity Dislocation Active Approach Holds Up Very Well

The good news for Equity Dislocation investors is that our risk controls and security selection did a lot of heavy lifting so far in 2023, and the Strategy outperformed MSCI ACWI Value minus MSCI ACWI Growth by an impressive 13.7% net of fees. Since inception, our decision to dial into the tails of the Value distribution (the very cheapest Value stocks and the most expensive Growth stocks) while moderating the exposure to unnecessarily big sector and individual stock bets has added meaningfully to performance.

What is Really Important in the Long Term?

Value continues to trade at an abnormally wide discount to Growth across a variety of valuation metrics. Many investors (or speculators?) believe that this is warranted given that Growth benefits from lower rates or that Value does badly in recessions. We do not believe that Value against Growth is an interest rate trade or is reliant on a “soft landing” (see Value Does Just Fine In Recessions). While it is true that rate-driven investor sentiment can support the prices of Growth stocks in the short term, ultimately share prices will be driven by whether companies can meet the expectations that investors have placed upon them. Indeed, we are not in any sense “anti” Growth stocks, we simply believe that many Growth stocks have been priced for unrealistically optimistic outcomes.

To put this in context, the investor sentiment behind Growth stalled very modestly in April, just to the extent that MSCI ACWI Value outperformed MSCI ACWI Growth by a marginal 60 bps. Against the backdrop of this slightly less benign environment for Growth, the two biggest contributions to Equity Dislocation performance came from U.S. Information Technology stocks in the short book, both were down more than 20%. What drove this harsh treatment from the market? One of them actually beat analysts’ estimates for the current quarter, but proffered relatively cautious guidance for the future, while the other suffered investors ire as revenue growth contracted to “only” 40% (this company remains unprofitable and, even after the fall, has a price to sales ratio in the high teens). Incidentally, one of these companies had a relatively uneventful May while the other soared to the tune of 47%, on the back of no further news or fundamentals, actually leaving it up 17% on its end of March valuation. All this volatility tells us is that the market has absolutely no idea what this company is actually worth, and possibly does not care.

While Growth stocks continue to be priced for unlikely outcomes, with absolutely no anchor to meaningful valuations, it is probable that they will inevitably disappoint regardless of whether they are good, or even very good, companies. The message is also clear that when Growth stocks do disappoint investors, the level of expected future rates does not provide any kind of safety net.

On the flipside, many of the stocks held in the Equity Dislocation long book appear to already be priced for disappointment. Of course, the exciting thing about stocks that are priced to disappoint is that they can do exceedingly well on the back of any good news. After releasing reasonable sales and earnings forecasts, the very much unloved Meta Platforms was the biggest individual contributor to Equity Dislocation so far in 2023, as its share price rocketed an incredible 119% for the period (though is still down broadly 30% from its 2021 high).

We would be delighted to speak with you further if you have any questions. Please do not hesitate to reach out to your GMO relationship manager or a member of our Asset Allocation team, or contact us for more information.

Download article here.