1: The U.S. Market

Well, the U.S. is really enjoying itself if you go by stock prices. A Shiller P/E of 34 (as of March 1st) is in the top 1% of history. Total profits (as a percent of almost anything) are at near-record levels as well. Remember, if margins and multiples are both at record levels at the same time, it really is double counting and double jeopardy – for waiting somewhere in the future is another July 1982 or March 2009 with simultaneous record low multiples and badly depressed margins.

But for those who must own U.S. stocks (most institutions) even when they are generally very overpriced, there is a reasonable choice of relatively attractive investments – relative, that is, to the broad U.S. market.

- Quality: Although not spectacularly cheap today, U.S. quality stocks 1 have a long history of slightly underperforming in bull markets and substantially outperforming in bear markets (although they did unusually well in the recent run-up). In addition, their long-term performance is remarkable. AAA bonds return about 1% a year less than low-grade bonds – everybody gets it, and always has. In bizarre contrast, the equivalent AAA stocks, with their lower bankruptcy risk, lower volatility, and just plain less risk, historically have delivered an extra 0.5% to 1.0% a year over the S&P 500 (to be precise, an extra 1.0% a year for the past 63 years, with the gains concentrated in the period since 2008). What on earth is that? Even holding their own should be inconceivable. It is the greatest aberration of all time in the market, and one I’m happy to say we at GMO realized 45 years ago, when Fama and French were still obsessing about returns to risky small cap and price to book. 2 And while I’m bragging, I should say that GMO has added a decent long-term increment to that generic 1%, totaling 1.3% a year above the S&P 500 in our Quality Strategy for the last 10 years. 3

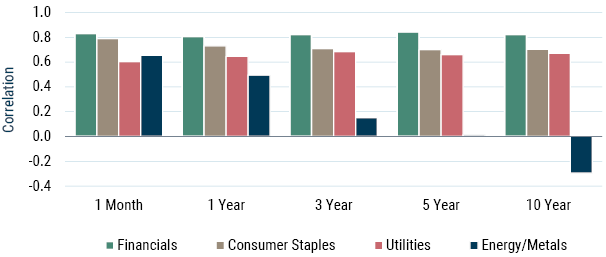

- Resource equities: Not only are raw materials finite – believe it or not! – getting scarcer, and therefore certain to rise in price, but at longer horizons (10 years) resources are the only sector of the stock market to be negatively correlated with the broad stock market. They are far and away the most diversifying sector (see Exhibit 1). They are also particularly cheap today having been whacked recently.

Exhibit 1: CORRELATIONS BETWEEN SECTORS AND THE REST OF THE TOP 1,000 U.S. COMPANIES: 1970-2023

As of 12/31/2023 | Source: MSCI, CRSP, GMO

- Climate-related investments: With increasing climate damage and the increasing willingness of governments to take action, I believe climate investments will have top-line revenue growth that is guaranteed to be above average for the next many decades, although with no guarantees as to the smoothness of that growth. But, with all the cost of solar, wind, etc. being up front and little of the cost being operational, climate investments are exceptionally discount rate-sensitive, which has hammered them over the past two and a half years. And in its usual way, the market has overreacted to the trend of rising rates, making these investments real bargains today. Today, solar stocks are priced at over a 50% discount to the broad equity market, and some of the best clean energy companies in the world trade at levels that imply negative real growth.

- Deep value: These stocks look cheap enough to be worth some investment, as the comparison with the total market is about as wide as it ever gets. The most expensive 20% of U.S. stocks are by definition always expensive, but today they are in the worst 10% of their 40-year range (compared to the top 1000 stocks). In great contrast, the cheapest 20% are in the best 7% of their range.

As for the U.S. market in general, there has never been a sustained rally starting from a 34 Shiller P/E. The only bull markets that continued up from levels like this were the last 18 months in Japan until 1989, and the U.S. tech bubble of 1998 and 1999, and we know how those ended. Separately, there has also never been a sustained rally starting from full employment.

The simple rule is you can’t get blood out of a stone. If you double the price of an asset, you halve its future return. The long-run prospects for the broad U.S. stock market here look as poor as almost any other time in history. (Again, a very rare exception was 1998-2000, which was followed by a lost decade and a half for stocks. And on some data, 1929, which was famously followed by the Great Depression. 4 )

Bubbles and AI

Looking backwards, what happened to our 2021 bubble? The Covid stimulus bubble appeared to be bursting conventionally enough in 2022 – in the first half of 2022 the S&P declined more than any first half since 1939 when Europe was entering World War II. Previously in 2021, the market displayed all the classic signs of a bubble peaking: extreme investor euphoria; a rush to IPO and SPAC; and highly volatile speculative leaders beginning to fall in early 2021, even as blue chips continued to rise enough to carry the whole market to a handsome gain that year – a feature hitherto unique to the late-stage major bubbles of 1929, 1972, 2000, and now 2021. But this historically familiar pattern was rudely interrupted in December 2022 by the launch of ChatGPT and consequent public awareness of a new transformative technology – AI, which seems likely to be every bit as powerful and world-changing as the internet, and quite possibly much more so.

But every technological revolution like this – going back from the internet to telephones, railroads, or canals – has been accompanied by early massive hype and a stock market bubble as investors focus on the ultimate possibilities of the technology, pricing most of the very long-term potential immediately into current market prices. And many such revolutions are in the end often as transformative as those early investors could see and sometimes even more so – but only after a substantial period of disappointment during which the initial bubble bursts. Thus, as the most remarkable example of the tech bubble, Amazon led the speculative market, rising 21 times from the beginning of 1998 to its 1999 peak, only to decline by an almost inconceivable 92% from 2000 to 2002, before inheriting half the retail world!

So it is likely to be with the current AI bubble. But a new bubble within a bubble like this, even one limited to a handful of stocks, is totally unprecedented, so looking at history books may have its limits. But even though, I admit, there is no clear historical analogy to this strange new beast, the best guess is still that this second investment bubble – in AI – will at least temporarily deflate and probably facilitate a more normal ending to the original bubble, which we paused in December 2022 to admire the AI stocks. It also seems likely that the after-effects of interest rate rises and the ridiculous speculation of 2020-2021 and now (November 2023 through today) will eventually end in a recession

2: Non-U.S. Equities and Real Estate

If things are so good, why on earth is the rest of the world so down at heel, with very average economic strength and average profitability and with both getting weaker? The UK and Japan are both in technical recessions; the EU, especially Germany, also looks weak; and China, which has done a lot of the heavy lifting in global growth for the last few decades, is pretty much a basket case for a while (although getting very cheap in its stock market). Global residential real estate looks particularly tricky also, although it often takes a very long time for prices to catch up or down with mortgage costs. Can any young couple in the developed world today buy a new home comparable to those bought at the same age by their parents? Peak prices as a multiple of family income multiplied by an old-fashioned looking mortgage rate (now 6.8% in the U.S.) makes for a very tough affordability calculation. And as for office space, forget about it. With the double problem of higher rates and Covid-induced work-from-home, no one is confident of anything, no one will build anything new, and all sit holding their breath as appraisals start to come down and bank loans to commercial property look increasingly dicey. And in China, extreme overbuilding threatens both housing and commercial real estate.

Throw in a couple of wars that refuse quick endings and rising possibilities of expanded military confrontations with Russia and China, and you can see why the rest of the world is sober and much more reasonably priced than the U.S. (Understanding U.S. optimism is much more difficult.) To be more precise, I would say that in contrast to extreme overpricing of U.S. equities, those overseas are a little overpriced, offering uninspired but positive returns. The positive exceptions to this general, moderate overpricing are at the value or low-growth end of emerging market equities and non-U.S. developed equities (including Japan), which are not only much cheaper than the high-growth varieties but are selling in a range from fair price to actually cheaper than normal. 5

GMO has a particularly soft spot for Japan, where we are optimistic that they can continue their recent slow-but-steady improvements in their version of corporate capitalism. Additionally, we are very confident that the yen will sooner or later gain 20% or even 30% against the dollar.

Finally, in the last few months, non-U.S. stocks have begun to perk up a little, even as the U.S. – in the midst of its AI bubble – vaults onwards to near unprecedented heights. Japan especially has been a strong recent performer. Fundamentally these have much more room to run than the U.S., with much less risk when the bubble bursts.

3: The Unpleasant and Threatening Issues That Lie in Wait for Global Economies

I’ve spent 90% of my time for the last 15 years studying what I call underrecognized long-term problems, and oh my has this been an interesting and busy time for such a specialty! Particularly right now as all these long-term issues, which seemed just a couple of years ago to be offering the hope of 5 or 10 years before they took a bite out of us, have decided to all arrive in a hurry.

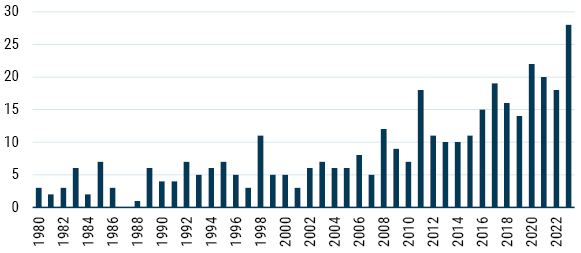

Climate damage a short while ago was a ‘he says, she says,’ thing. Who to believe? Now only idiots and ideologues are non-believers. Last year was not just the warmest year since humans evolved. It was the warmest year by the biggest increment ever. 6 If you include the most recent data and take the 12 months ended this January 31st, the world has breached the dreaded 1.5°C above pre-industrial level. 7 And anyone who thought 1.0°C or 1.5°C seemed like such little numbers has been disabused by the avalanche of damaging climate incidents of over $1 billion each (see Exhibit 2). Globally last year GDP was reduced by over 1%, which at 2.9% total growth 8 is a lot, with poorer countries suffering a disproportionate share of that damage. 9 Unprecedented ‘atmospheric rivers’ are dropping a month’s normal rain in a day on our son’s family in California as I write this in early February. 10 Yesterday well over 100 people died in unprecedented forest fires in Chile. 11 The day before…etc. Everyone is suddenly beginning to talk about insurance premiums rising from climate damage as a serious cost pressure. (And in an increasing number of cases, insurance is simply unavailable.)

Exhibit 2: United States Billion-Dollar (CPI-Adjusted) Weather and Climate Disasters, 1980-2023

As of 1/9/2024 | Source: NCEI

Resource limitations were not really a problem until about 2000, when prices started to rise after 100 years of real (after inflation) decline. GMO’s index of 34 equal-weighted commodities, which fell from an indexed 100 in 1900 to a low of 30 in 2002 (which, by the way, was only a very mild recession) is now around 65, having returned to its original 100 three times since 2002, including as recently as 2022. The impression it gave at the turn of the century of being in remorseless decline is no longer evident at all. At best it has been wandering sideways, with volatility, for decades. I personally believe it is likely to go to new highs in the next 20 years, especially given the pressures on copper, nickel, cobalt, and other metals needed to green the economy. This is a very different world brought on, we believe, by the remarkably sustained growth of China since 1990 and the beginning of the end of very cheap reserves for many commodities. When things are finite, they do run out. Now we are faced with bottlenecks here, there, and everywhere, with handsome gluts and price falls thrown in, which is simply how commodities work, whether irregularly falling or rising. But slowly rising, volatile prices are a pain compared to the wonderful lost world of the 20th century’s declining prices.

Toxicity levels in our world have been rising at incredible rates carried along by similar gains in plastics and chemical production. Plastics with their wonderful feature of indestructibility have this dreadful feature of indestructibility. What is worse is that as plastics break into smaller pieces they have the potential to become much more dangerous, for the nano-level plastics have entered our bloodstreams and our brains and those of every animal under the sun. (The fact is we don’t know just how dangerous all those nanoparticles are in our bodies because we have not done the testing yet. But the prospects don’t feel good, do they?) The weight of plastic waste has been calculated to be more than that of all living animals. 12 It is growing at an astonishing half a billion tons every year 13 and very ominously is still targeted for rapid growth into the indefinite future!

Chemicals though are even worse. 350,000 of them 14 are produced at a scale of millions of tons and none of them are tested for toxicity in combination with each other – the way they actually occur – and very few are even tested alone. At least 10,000 of these 15 are ‘forever chemicals’ whose bonds cannot ever be broken down by nature. Untold thousands of these chemicals, and not just the ‘forever’ variety, are endocrine disruptors that mess with our hormones and interfere with the fertility of insects, amphibians, and mammals – notably including humans. This onslaught of man-made complex chemicals has, it seems, made our environment hostile to life. And just as much as the collapsing insect populations pay the price, so does human fertility and our general health.

Add growing toxicity and fertility problems to the long list of reasons for women to postpone or avoid childbirth (all of them very reasonable) and we are guaranteed to have a continued decline in both our baby cohorts and in our workforce for the foreseeable future. Our populations have been ageing for a couple of decades and this will continue. Older workforces are less productive, and retirees, as currently configured, are not only totally unproductive but resource intensive. Japan is 30 years into population decline and their cohort of 18-year-olds is already down over half from the peak. 16 However, my joke-serious investing rule #7 is never, ever extrapolate from Japan! Their society is very, very different and their social contract – willingness to forego individual interests for the common good – is much, much stronger. It is easy, for example, to imagine that if 18-year-olds in the U.S. were down this much, it would cause a very major crisis indeed.

The negative impacts of these several long-term forces are upon us now and are already holding growth back. Further declines in babies and workforces and further ageing of the population profile are certain. As is increasing damage to the environment from rising toxicity and rising counts of greenhouse gases. In comparison to these certainties there is more room for argument about resources limitations, but the data doesn’t lie: we are beginning to run out. And while these longer-term fires begin to burn, what do we do? We fiddle. And obfuscate to protect vested interests. And ignore, because not to do so is unpleasant. I’m sympathetic because a lot of this is very uncomfortable to think about!

From all of this, the key question for investing is: can we sneak into these more reasonably priced markets and take our profits before the gathering army of formerly long-term negatives that I described earlier, combined with the unpredictable outcomes of our two wars, and the resulting much deteriorated prospects for international relationships and trade, bite us hard on the bottom and risk turning a slowdown or a mild recession into something substantially more serious and long-lived?

The paradox that worries me here for the U.S. market is that we start from a Shiller P/E and corporate profit margins that are near record levels and therefore predicting near perfection; yet we face in reality not just a very risky disturbed geopolitical world, with growing concerns about democracy, equality, and capitalism, but also an unprecedented list of long-term negatives beginning to bite. The stark contrast between apparent embedded enthusiasm and these likely problems seems extreme, illogical, and dangerous.

P.S. For those with a strong stomach, we are going to produce a series of six papers examining in some detail these longer-term negatives mentioned here. Paper one, the introduction, will be out next week and paper six, I hope by year end. A stiff whiskey is recommended for each of these. Stay tuned. (A sneak preview can be had in a mammoth podcast at The Great Simplification, Episode 99 or on YouTube.)

Download article here.

The essence of a quality stock is a high stable return on equity and an impeccable balance sheet.

Ben Inker recently broached this topic in GMO’s Q4 2023 Quarterly Letter, The Quality Anomaly: The Weirdest Market Inefficiency in the World (December 2023).

Net of fees, as of January 31, 2024. The Quality Strategy is not managed relative to the S&P 500. References to the index are for comparison purposes only.

See the first chart of Hussman’s “Cluster of Woe,” Hussman Market Comment, February 4, 2024.

See GMO’s 7-Year Asset Class Forecast for full details.

Lindsey and Dahlman, Climate Change: Global Temperature, NOAA Climate.gov, January 18, 2024.

Freedman, Record January Caps Earth’s First 12-Month Period Above 1.5°C Target, Axios, February 8, 2024.

OECD, OECD Economic Outlook 2023, no. 2, November 2023.

Siders, Report – Loss and Damage Today: The Uneven Effects of Climate Change on Global GDP and Capital, University of Delaware Climate Change Hub, November 28, 2023.

February 2024 California Atmospheric Rivers, Wikipedia, accessed February 29, 2024.

Ore et al., Forest Fires Kill 123 in Chile’s Worst Disaster Since 2010 Earthquake, Reuters, February 5, 2024.

Resnick and Zarracina, All Life on Earth, in One Staggering Chart, Vox, August 15, 2018; Ritchie, FAQs on Plastics, Our World in Data, September 2, 2018.

Ritchie et al., Plastic Pollution, Our World in Data, accessed February 29, 2024.

Wang et al., Toward a Global Understanding of Chemical Pollution: A First Comprehensive Analysis of National and Regional Chemical Inventories, Environmental Science & Technology, January 22, 2020.

Sneed, Forever Chemicals Are Widespread in U.S. Drinking Water, Scientific American, January 22, 2021.

Japan’s 18-Year-Olds at Record-Low 1.06 Million on Falling Births, The Japan Times, December 31, 2023.

Disclaimer: The views expressed are the views of Jeremy Grantham through the period ending March 2024 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2024 by GMO LLC. All rights reserved.

The essence of a quality stock is a high stable return on equity and an impeccable balance sheet.

Ben Inker recently broached this topic in GMO’s Q4 2023 Quarterly Letter, The Quality Anomaly: The Weirdest Market Inefficiency in the World (December 2023).

Net of fees, as of January 31, 2024. The Quality Strategy is not managed relative to the S&P 500. References to the index are for comparison purposes only.

See the first chart of Hussman’s “Cluster of Woe,” Hussman Market Comment, February 4, 2024.

See GMO’s 7-Year Asset Class Forecast for full details.

Lindsey and Dahlman, Climate Change: Global Temperature, NOAA Climate.gov, January 18, 2024.

Freedman, Record January Caps Earth’s First 12-Month Period Above 1.5°C Target, Axios, February 8, 2024.

OECD, OECD Economic Outlook 2023, no. 2, November 2023.

Siders, Report – Loss and Damage Today: The Uneven Effects of Climate Change on Global GDP and Capital, University of Delaware Climate Change Hub, November 28, 2023.

February 2024 California Atmospheric Rivers, Wikipedia, accessed February 29, 2024.

Ore et al., Forest Fires Kill 123 in Chile’s Worst Disaster Since 2010 Earthquake, Reuters, February 5, 2024.

Resnick and Zarracina, All Life on Earth, in One Staggering Chart, Vox, August 15, 2018; Ritchie, FAQs on Plastics, Our World in Data, September 2, 2018.

Ritchie et al., Plastic Pollution, Our World in Data, accessed February 29, 2024.

Wang et al., Toward a Global Understanding of Chemical Pollution: A First Comprehensive Analysis of National and Regional Chemical Inventories, Environmental Science & Technology, January 22, 2020.

Sneed, Forever Chemicals Are Widespread in U.S. Drinking Water, Scientific American, January 22, 2021.

Japan’s 18-Year-Olds at Record-Low 1.06 Million on Falling Births, The Japan Times, December 31, 2023.