The U.S. stock market has been the place to be for some years, driven by blistering growth rates at the leading Technology businesses. With that backdrop, the average U.S. investor is likely to have increasingly concentrated exposure to the largest U.S. growth stocks. Indeed, an investor in the U.S. growth indices probably has more than half of their portfolio in the “Magnificent 7” and has likely been rightly delighted with the returns they have achieved.

In this context, diversification has been a tough sell. Allocating to anything else – bonds, small caps, you name it – has only reduced returns when looking in the rearview mirror. Of course, when you build a portfolio, you do so for the future, not the past. Counterintuitively, the riskiest moment for an equity investor may turn out to be the moment there wasn’t a cloud in the sky – because we like to extrapolate success, and clouds can reappear. Today it’s hard to see many clouds around U.S. growth stocks. In this note, we argue that every investor should build more international diversification into their portfolio, and that International Quality investing is a way to do so that seeks to control what we view as the most important risks without limiting long-term returns.

U.S. markets have become highly concentrated

Over the last few years, the U.S. stock market has become rather concentrated in just a handful of the largest companies. Like others, we worry that U.S. investors are sitting on a good deal of risk. So far this risk has paid off, but it remains risky none the less. What happens if the AI boom stutters? Could new challenges emerge? What are the implications of the enormous capex requirement for AI? Investing can be at its most dangerous when prospects appear the rosiest.

EXHIBIT 1: THE RISK OF AN INCREASINGLY CONCENTRATED U.S. MARKET

As of 12/31/2024 | Source: S&P, MSCI, GMO

Many of the most successful businesses today are American, but not all of them!

The return to long-term shareholders is driven mainly by a company’s success in terms of growing earnings per share (EPS) and dividends paid to shareholders. Quality investors aim to exploit the long-term fundamental success of the best businesses by participating in their growth and pay-out. While Technology stocks have dominated in recent years, many of the leading businesses are domiciled outside of the U.S. The world’s most sophisticated manufacturer of semiconductors is Taiwan Semi. The most seasoned luxury brands – think Louis Vuitton and Cartier – are mainly European. The world’s scale catering firm, Compass Group, is headquartered in London. Such businesses often have strong long-term records of capital allocation that, combined with their natural competitive advantages, have often resulted in enviable EPS growth and dividend records, and thus strong shareholder returns.

International Quality Case Study: ASML. ASML is central to the process of manufacturing advanced semiconductors. This Dutch leader makes the machines that enable intricate circuits to be mapped onto silicon wafers using very short-wavelength light. Their machines contain hundreds of thousands of components, largely supplied by third parties in Europe and the U.S., making their painstakingly assembled technology extraordinarily difficult to replicate. The company has a strong balance sheet and is well-placed to benefit from secular demand for ever more powerful silicon chips.

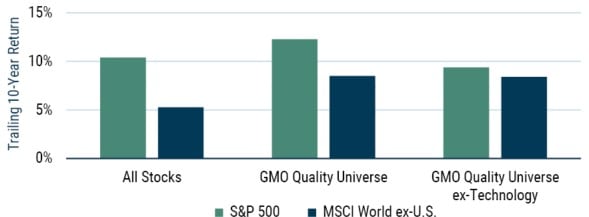

International Quality stock returns are comparable to their U.S. equivalents, ex-Technology

It is true that the average international stock has generated lower returns than the average U.S. stock for some time. Over the last decade, for example, U.S. stocks have delivered over 4% more per annum. But why settle for average? If we narrow our focus to the highest quality U.S. and international businesses, 1 we find that International Quality generated a return around 1% less than the U.S. market. And if we measure the returns to U.S. and International Quality stocks outside of broad Technology, 2 the returns to the U.S. and International Quality stocks are roughly the same. We believe that International Quality investing therefore has the potential to diversify exposure to the U.S. markets without sacrificing return.

EXHIBIT 2: EXPLAINING THE GLOBAL EQUITY PERFORMANCE GAP

Total annualized return

As of 12/31/2024 | Source: GMO

The GMO Quality Universe includes the top one third of high-quality companies globally based on a combination of high and stable return on capital and a strong balance sheet. The GMO Quality Universe ex-Technology is the GMO Quality Universe, excluding Information Technology and Communication Services GICS sectors.

International Quality Case Study: LVMH. Louis Vuitton Moet Hennessy is the largest luxury goods house on the planet. Its list of brand names is a roll call of beloved “maisons,” creating quality goods in fashion, champagne, cosmetics, jewellery, and more. The company has been patiently assembled by French entrepreneur and controlling shareholder Bernard Arnault over several decades, a timeframe in which it has comfortably outperformed the S&P 500. LVMH’s business has slowed following a post-pandemic surge, creating what we believe will prove to be a profitable entry point.

Quality may have more of a relative edge in international markets

We believe focusing on quality is actually more important when investing in international markets than when investing in the U.S. That’s because the average quality (based on GMO’s measures) of the international market is lower than that of the U.S. As we have pointed out, there are many great companies outside the U.S., but it is also true that there are significantly more “quality traps” – that is, companies that do not generate sufficient return on capital to justify their existence. We believe investing in such companies will inevitably disappoint over time, and that starting at a point that avoids these companies may give one a significant leg up. Today, more than half of international businesses run with a return on assets of less than 6%, while only a quarter of U.S. businesses do the same. Finding strong capital allocators is a key focus of GMO’s approach.

EXHIBIT 3: INTERNATIONAL INVESTING DEMANDS A QUALITY FOCUS

Percent of market generating return on assets less than 6%

As of 12/31/2024 | Source: MSCI, WorldScope, GMO

The international universe includes constituents of the MSCI EAFE and MSCI China Indexes. The U.S. universe includes constituents of the S&P 500 Index.

International Quality Case Study: Inditex. Headquartered in Spain, Inditex is the owner of Zara, Massimo Dutti, Pull&Bear, and several other clothing brands. It is the scale player in the global apparel retail market with a distinctive business model in an often commoditized and fragmented marketplace. Eschewing low-cost Asian manufacture and embracing a high-tech approach to inventory management, Inditex specializes in reacting to fashion demand dynamically and has built a world-beating business. Companies listed in Spain are not known for their high returns on assets. Inditex is an exception with no need for leverage to generate an enviable return on capital for its shareholders.

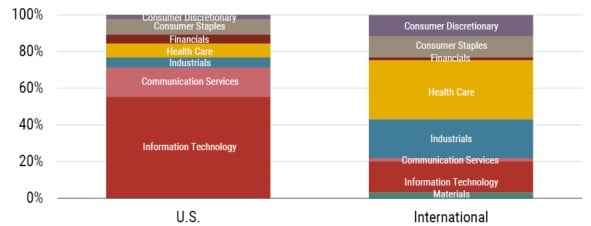

International Quality can help diversify your U.S. equity investments

Our final point is that an allocation to International Quality can help diversify your U.S. holdings irrespective of whether you accept any of the arguments above. International markets are much more diversified by industry than U.S. markets. The International Quality universe is much more diversified than the equivalent U.S. Quality universe, which currently has 71% in broad Technology. Moreover, as noted above, International Quality businesses are often the leaders in industries where the U.S. is underrepresented.

EXHIBIT 4 : INTERNATIONAL QUALITY OPENS UP A DIFFERENT OPPORTUNITY SET

U.S. vs. International Quality by GICS sector

As of 12/31/2024 | Source: MSCI, GMO

Of course, International Quality also offers greater geographic diversification. This can be thought of in different ways. While the companies in our U.S. Quality ETF (NYSE: QLTY) generate more than half of their revenues in the U.S., we estimate that about two thirds of the revenue from our newly launched International Quality ETF (NYSE: QLTI) will come from elsewhere. While U.S. companies are typically headquartered and taxed principally in a single jurisdiction – the U.S. – International Quality companies are headquartered across a more diverse array of countries in Europe (both inside and outside the EU) and in Australasia, making them less sensitive to any single group of politicians. That said, we invest largely in multinationals, no matter the domicile, and therefore think about the diversification opportunity more in terms of specific company and business model risks first, and macroeconomic diversification second.

International Quality Case Study: Hoya. Hoya’s core optical technology is a legacy from its origins as Japan's first optical glass specialist. This technology forms the backbone of a product range from vision-correcting glasses via “intraocular” lenses for cataract patients and applications in medical imaging to the manufacture of mask blanks for semiconductors. Hoya clientele is truly globally diversified, with less than a quarter of revenues coming from Japan and more than 40% from Europe and the Americas. Combined with the company’s capital discipline and stable but high return on capital, we believe Hoya makes an attractive investment.

Conclusion

We have been investing in Quality businesses for more than two decades. We believe that Quality businesses have a tailwind from their stronger fundamentals. They have the desirable feature of having held up better than the broader markets when times were hard. In our view, by keeping an eye on valuation, our investors may run a lower risk of being carried over the top with dangerously priced assets.

In recent years, we've increasingly allocated to international businesses in our flagship Quality Fund. 3 We believe that International Quality stocks share the same basic characteristics (stronger fundamentals, above average resilience) as U.S. Quality stocks, while offering valuable diversification. QLTI, launched in October 2024, makes this diversification available in GMO-managed ETF form for the first time. We invite you to take a look.

Download article here.

Jeremy Grantham developed what was perhaps the first systematic approach to identifying high-quality businesses in the early 1980s. It was based on a combination of high and stable return on capital and a strong balance sheet. The data we use here applies an updated, but broadly similar, approach to identify companies in the top one third of quality globally.

We prefer to group Technology and Communication Services together. In a quality context, this means grouping Alphabet and Meta among the tech businesses that have similar drivers.

GMO’s flagship Quality portfolio, the GMO Quality Fund, is a global portfolio that incepted February 6, 2004. As of January 31, 2025, the Fund’s U.S. and international equity exposures were approximately 76% and 24%, respectively.

Portfolio holdings are percent of equity. Where applicable, the top holdings are derived by looking through to the underlying portfolios in which the asset allocation strategy invests and, where appropriate, individual security positions are aggregated. They are subject to change and should not be considered a recommendation to buy individual securities.

Risks associated with investing in the GMO U.S. Quality ETF (NYSE: QLTY, “the Fund”) may include: (1) Market Risk - Equities: the market price of equities may decline due to factors affecting the issuer, its industries, or the economy and equity markets generally. Declines in stock market prices generally are likely to reduce the net asset value of the Fund's shares; (2) Management and Operational Risk: the risk that GMO's investment techniques will fail to produce desired results, including annualized returns and annualized volatility; and (3) Focused Investment Risk: the Fund invests its assets in the securities of a limited number of issuers, and a decline in the market price of a particular security held by the Fund may affect the Fund's performance more than if the Fund invested in the securities of a larger number of issuers. For a more complete discussion of these and other risks, please consult the Fund's Prospectus.

Risks associated with investing in the GMO International Quality ETF (NYSE:QLTI, “the Fund”) may include: (1) Market Risk - Equities: the market price of equities may decline due to factors affecting the issuer, its industries, or the economy and equity markets generally. Declines in stock market prices generally are likely to reduce the net asset value of the Fund's shares; (2) Management and Operational Risk: the risk that GMO's investment techniques will fail to produce desired results, including annualized returns and annualized volatility; and (3) Non-U.S. Investment Risk: the market prices of many non-U.S. securities (particularly of companies tied economically to emerging countries) fluctuate more than those of U.S. securities. Many non-U.S. markets (particularly emerging markets) are less stable, smaller, less liquid, and less regulated than U.S. markets, and the cost of trading in those markets often is higher than it is in U.S. markets. For a more complete discussion of these and other risks, please consult the Fund's Prospectus.

Risks associated with investing in the GMO Quality Fund (“the Fund”) may include: (1) Market Risk - Equities: the market price of equities may decline due to factors affecting the issuer, its industries, or the economy and equity markets generally. Declines in stock market prices generally are likely to reduce the net asset value of the Fund's shares; (2) Management and Operational Risk: the risk that GMO's investment techniques will fail to produce desired results, including annualized returns and annualized volatility; and (3) Focused Investment Risk: the Fund invests its assets in the securities of a limited number of issuers, and a decline in the market price of a particular security held by the Fund may affect the Fund's performance more than if the Fund invested in the securities of a larger number of issuers. For a more complete discussion of these and other risks, please consult the Fund's Prospectus.

An investor should consider the funds’ investment objectives, risks, charges and expenses before investing. This and other important information can be found in the fund prospectus. To obtain a prospectus please visit www.gmo.com. Read the prospectus carefully before investing.

The GMO ETFs are distributed in the United States by Foreside Fund Services LLC. GMO and Foreside Fund Services LLC are not affiliated.

The GMO Trust funds are distributed in the United States by Funds Distributor LLC. GMO and Funds Distributor LLC are not affiliated.

Worldscope is a data provider. Results are a representation of historical data and are no guarantee of future results. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Please visit GMO's benchmark disclaimers page to review the complete benchmark disclaimer notice. S&P does not guarantee the accuracy, adequacy, completeness or availability of any data or information and is not responsible for any errors or omissions from the use of such data or information. Reproduction of the data or information in any form is prohibited except with the prior written permission of S&P or its third-party licensors. Please visit GMO's benchmark disclaimers page to review the complete benchmark disclaimer notice.

Disclaimer: The views expressed are the views of Anthony Hene, Tom Hancock, and Ty Cobb through the period ending February 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

Jeremy Grantham developed what was perhaps the first systematic approach to identifying high-quality businesses in the early 1980s. It was based on a combination of high and stable return on capital and a strong balance sheet. The data we use here applies an updated, but broadly similar, approach to identify companies in the top one third of quality globally.

We prefer to group Technology and Communication Services together. In a quality context, this means grouping Alphabet and Meta among the tech businesses that have similar drivers.

GMO’s flagship Quality portfolio, the GMO Quality Fund, is a global portfolio that incepted February 6, 2004. As of January 31, 2025, the Fund’s U.S. and international equity exposures were approximately 76% and 24%, respectively.