Overview

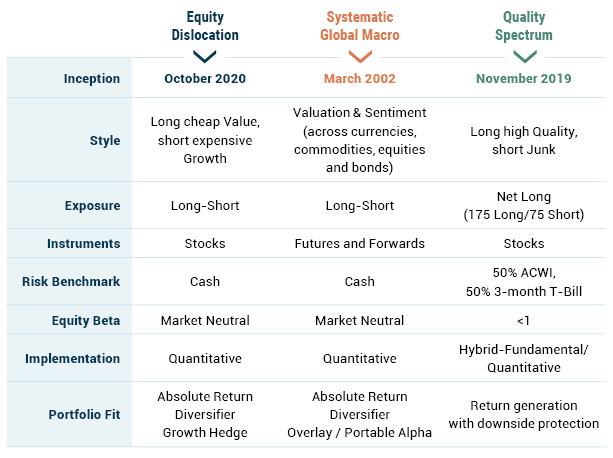

In this webcast, three veteran alternative strategy managers at GMO, Jason Halliwell, Systematic Global Macro; Tom Hancock, Quality Spectrum; and Ben Inker, Equity Dislocation; discussed a critical element that has allowed their strategy to thrive and how they have evolved to suit today’s environment.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

1. Surprising success factor

Ben Inker, Equity Dislocation: Building a strategy around a single opportunistic/temporary idea

Equity Dislocation is just the latest in a series of portfolios we've run over the past 30 years when we have seen big dislocations in the market. A non-intuitive success factor here is the fact that we are explicitly not trying to run a strategy that would make sense at all times. We are unapologetically long value stocks and short growth stocks. About half the time, that's a pretty stupid idea. If the spread between value stocks and growth stocks is tight, you would not want to systematically be long value and short growth.

Jason Halliwell, Systematic Global Macro: Oversight (and ability to override) the systematic process

We think being systematic is very important, but the model doesn't know everything; you have to monitor the model and look for situations where you have to intervene. An example was COVID-19. If you are going to panic, panic early. In early February, even in January 2020, we thought COVID-19 was an underappreciated risk, it had escaped containment. We changed the portfolio early - from long positions to short beta positions. The worst we can do is panic at the wrong time and take losses.

Tom Hancock, Quality Spectrum: Concentration (long side) and diversification (short side)

Quality Spectrum is long high quality companies and short low quality companies, taking advantage of a volatility difference where high quality companies are less volatile and low quality companies more so. You can be net long and still have a relatively low beta. For long positions, the loss is capped and the upside is unlimited; the short side is the reverse. On the long side, we hold 40 stocks, on the short side, 400. On the short side, too much exposure to a single name can be very, very dangerous.

2. Strategy Evolution

Ben Inker, Equity Dislocation: Learning from experience to emphasize what works

Some growth stocks disappoint, and the market hits them hard. Some value stocks surprise to the upside. We have had some success on these growth traps and value upside surprises, so we recently made a change to maximize our odds of capturing those growth traps and value surprises by dialing up the effective weight of corporate alerts (signals a company is doing something unsustainable).

Jason Halliwell, Systematic Global Macro: Redesigning sentiment

Momentum is an important part of sentiment, but 2008 seems to be an inflection point where simple trend stopped generating alpha. We have evolved to look at the same data through a sophisticated pattern recognition technology. The simplest versions of signals get commoditized, and we always have to be refreshing what we do to really keep up with what is likely to happen in the future.

Tom Hancock, Quality Spectrum: Power of packaging

We have been running long-short quality portfolios since 2004, and have learned the power of packaging the long and the short side together. Shorting junk stocks is an efficient tail risk hedge, but it is insurance and, therefore, has a negative expected return over time. That is a difficult line item to hold whereas the net long (175, 75) works as a standalone item with positive forecasted return and downside protection.

Sample Q&A:

Q. How do you expect hedge funds (generally) to fare in higher interest rate environments like today?

A. For a derivative-based strategy, you earn more on the underlying cash. Higher rates means more dispersion and better opportunities in rates and currency positions. The rate environment has implications for other asset classes (e.g., equities), so you need to account for it in the model.

Q. Is one of the biggest mistakes you can make in hedge fund management not taking enough risk?

A: Yes, we think risk taking is critical to success. Risk is a mistake you can make in both directions, so you want to focus on structure and implementation; are your managers poised to both capture upside, and not inflict too much pain or damage on the downside? Our founder, Jeremy Grantham, has a quote we love, “Our job as managers is to inflict as much pain as clients can stand, and not more.”

Q. What do you perceive as the biggest risks for the proliferating number of semi-liquid alternative funds such as tender offer and interval funds? Any advice to those newer to illiquid investing?

A. If you are new, start small. Semi-liquid investments can rapidly become illiquid, and liquidity often disappears when you most need it. Only invest an amount that you can afford to have stay illiquid.

Download event highlight here.