Overview

GMO believes that the movement of supply chains out of China presents a tremendous opportunity for companies in other emerging markets. In this webcast, Warren Chiang, portfolio manager for GMO’s Systematic Equity team, and Arjun Divecha, founder of GMO Emerging Markets, discuss why they believe an actively managed approach is the best way to capture this theme, diversify portfolios, and add value in this environment.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

We are seeing a secular shift of supply chains moving out of China. There are several reasons for this including increasing labor costs in China, increasing risk from geopolitical tensions, and diversification from the single supplier model.

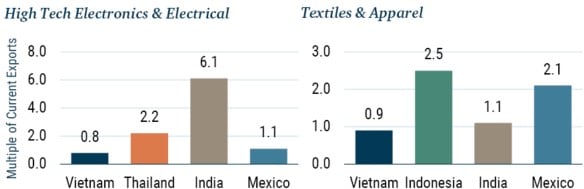

The movement of supply chains is in its early stages, with significant room for growth even if modest levels of Chinese exports move to other markets. For example, a modest 10% shift in Chinese exports can have a meaningful impact to a range of countries and industries including high tech electronics in India, textiles and apparel in Indonesia, and autos in Vietnam.

10% OF CHINA’S INDUSTRY EXPORTS SCALE TO A MULTIPLE OF PEERS’ CURRENT EXPORTS

As of 5/31/2023 | Source: UNCTAD, GMO

Several examples of how EM countries are positioned to benefit from this already are:

- Taiwan tech is shifting away from China

- Mexico is already growing private construction at 20%

- Indian companies have doubled their sales in the past four years, with strong government support

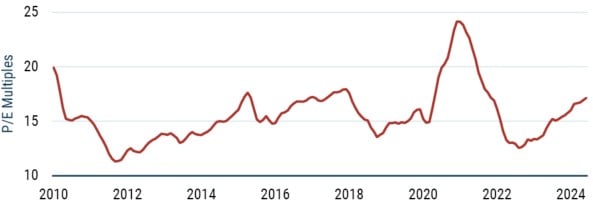

The “Beyond China” Universe is not expensive

As of 8/31/2024 | Source: MSCI, GMO

Data is 3-months rolling. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

- There is an opportunity for investors - using an actively managed thematic offering which focuses on selecting the countries and sectors that may potentially benefit, and aims to identify the highest quality companies at reasonable valuations within these sectors. We believe the Beyond China strategy captures a growing theme which is not currently priced into valuations. This Strategy is available now via the GMO Beyond China ETF (NYSE: BCHI).

Download event highlight here.