Overview

In this webcast, GMO’s head of Focused Equity, Tom Hancock, and co-head of Asset Allocation, John Thorndike, discussed why diversifying by owning quality and deep value equities can help offset risk in today’s highly concentrated market. Tom described how the GMO Focused Equity team combines quantitative and fundamental analysis to identify companies with strong moats and high return on invested capital that are likely to remain relevant for years ahead. John discussed the opportunity in value today, and how GMO’s approach uncovers deeply discounted equities of companies with relatively attractive quality and growth characteristics while avoiding junkier names.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- Diversification is hard to come by in such a concentrated market. The Top 10 stocks in the U.S. market represent over 35% of the total market cap and contribute nearly half of the overall volatility. Further, this narrow group’s correlation with the rest of the market is near a record low, leaving most investors less diversified than they may believe.

- Quality and deep value equities offer attractive ways to diversify today. Quality equities are a core holding that allows investors to participate in the long-term upside of equities while also historically outperforming in down markets. Deep value (the cheapest 20% of the market) is extraordinarily dislocated offering the potential for high excess returns.

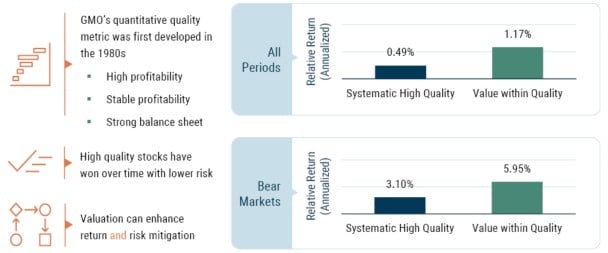

GMO Quality: the Ability to Add Value

April 1928 – December 2023 | Source: GMO

Bear market is the drop in prices of at least 20% from any peak over a period of at least 3 months. GMO Quality is the highest quality 1/3 of the U.S. market. Value within Quality is the low valuation half of that, relative to the broader U.S. market.

- GMO has a long and successful track record of Quality investing. GMO has over 20 years of experience blending quantitative and fundamental quality research efforts in a valuation-sensitive framework.

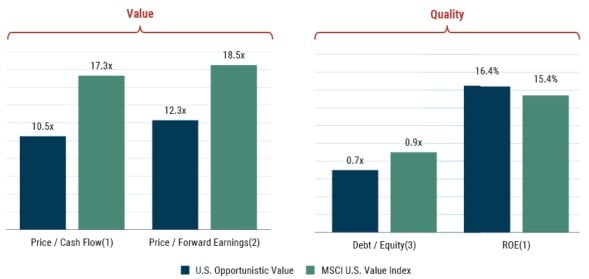

- GMO combines top-down and bottom-up efforts to capitalize on value opportunities. Deep value is trading at record discounts in the U.S. and developed ex-U.S. markets, yet is not simply a junky basket of stocks. GMO builds a more realistic starting point than reported book value and then forms a unique growth projection calibrated on each company’s historic results, outlook, and characteristics.

Building a cheap portfolio that isn’t junky

U.S. Opportunistic Value Strategy exposure characteristics

As of 9/30/2024 | Source: GMO

(1) Historical 1-year weighted median

(2) Forecast 1-year weighted median

(3) Weighted median

The information in the exhibit is based on a representative account in the Strategy selected because it has the fewest restrictions and best represents the implementation of the Strategy. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

- GMO products offer exposure to these diversifying strategies. The GMO U.S. and International Opportunistic Value strategies and GMO International Quality strategy aim to capitalize on the deep value and quality opportunities in the U.S. and developed ex-U.S. markets. These strategies are available through a variety of vehicles, including recently launched ETFs. To learn more about GMO's ETFs, visit ETF Investing at GMO.

Download event highlight here.