Overview

In this webcast, co-head of GMO’s Asset Allocation team, Ben Inker, discusses GMO’s highest conviction investment ideas today. Ben also explains how a valuation-sensitive, multi-asset portfolio can improve traditional strategic allocations by dynamically shifting exposures across a broad set of return sources.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- Traditional balanced portfolios (even those with “alternatives” such as private equity or credit) rely predominantly on equity and bond risk premia to generate returns, and can suffer long periods of anemic returns. The passively allocated portfolio delivered these disappointing returns after periods in which stocks and/or bond valuations were elevated.

- We believe static allocations can be improved by using valuations to time exposure to risk assets, either offensively or defensively, and tapping into more return sources when appropriately priced. By expanding beyond traditional risk premia, investors leverage other ways to get paid which can help diversify risks and enhance returns.

- Today, GMO’s Asset Allocation strategies are leveraging three key opportunities driven by their attractive absolute and relative valuations:

- Non-U.S. vs. U.S. equities: U.S. equities trade expensively relative to their history and other regions with a CAPE ratio of nearly 37x CAPE vs. 25x for MSCI EAFE and 17x for MSCI Emerging as of 3/31/24. While U.S. fundamental growth has been in line with our long-term expectations over the last decade, some markets like Japan have delivered exceptionally strong growth and offer more attractive valuations. Emerging market fundamentals disappointed but remain priced for excessively weak growth ahead.

- Long-only Deep Value equities: Deep Value (cheapest 20%) is truly dislocated, and is currently the biggest active position across GMO’s asset allocation portfolios. We hold long positions in the U.S. and International Opportunistic Value portfolios – both recently launched to capture this Deep Value opportunity.

- Long/Short equity alternative: The spread between the cheapest Deep Value equities and extreme Growth is near record levels. We are capturing this opportunity long-short via our Equity Dislocation portfolio, which is 100% long the cheapest Value stocks and 100% short the most expensive Growth stocks.

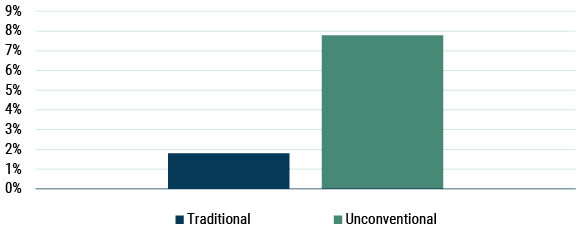

- We believe "unconventional" strategies allocated like GMO’s Benchmark-Free Allocation Strategy are poised to deliver attractive absolute returns while meaningfully outperforming a traditional 60/40 allocation:

Real Return Forecasts (GMO Low Forecast Scenario)

As of 3/31/2024 | Source: GMO

Download event highlight here.