Tilting a high-yield (HY) portfolio toward BB-rated bonds, which form the basis of the GMO High Yield Strategy’s top-down Quality factor allocation, may offer a strategic performance advantage in HY portfolios through the credit cycle. Moreover, we believe there is value in tactically increasing allocations to these high-quality bonds in the current environment, given absolute spread levels in HY and the relative valuation among different rating cohorts.

Strategic Allocation: Comparable Returns for Historically Lower Risk

BB bonds have historically delivered returns on par with the broader HY market. From 2001 to 2024, the BB Index 1 achieved an annualized excess return of 3.6%, nearly in line with the 3.7% return of the Bloomberg U.S. High Yield Index. Given the higher-quality nature of BBs, this return was achieved at a lower volatility than that of the overall HY market – 8.4% for BBs versus 10.1% for HY – leading to a much more attractive risk-adjusted return profile. Our research suggests that this is a function of the “Fallen Angel” effect in BBs, 2 in combination with other structural issues that lead investors to demand a relatively higher yield in BBs than is justified by their credit risk. It is because of this strategic value-add property over the credit cycle that GMO’s High Yield Strategy typically maintains a dedicated allocation to the Quality factor via BB bonds, in addition to the diversification this allocation provides when combined with the other top-down factors we employ.

Tactical Allocation: Varying Allocations Based on Alpha Potential Can Be Additive

In addition to a strategic long-term allocation, we also vary the Strategy’s exposure dynamically based on our quantitative alpha-potential signals. Broadly, these signals lead us to increase our allocation to Quality bonds when HY market spreads are tight. While spreads were tight for most of 2024, we increased our portfolio’s BB exposure in a measured and staggered manner, implementing the first stage in the spring and taking it up to its maximum in November. 3

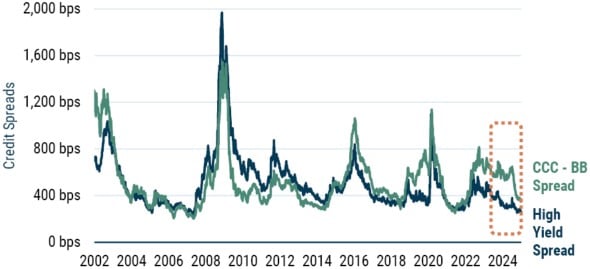

We did this because our other set of quantitative signals indicated high dispersion in the HY index. As illustrated in the Exhibit below, the gap between CCC and BB bonds continued to remain elevated through the first half of 2024 despite tight HY spreads. Indeed, through mid-July, even as the Bloomberg U.S. High Yield Index had tightened by 27 bps, the CCC cohort was 46 bps wider. Remarkably, these low-rated bonds ended the year tightening by a whopping 200 bps, delivering 11.7% in excess return versus government bonds and thereby normalizing the dispersion gap to BBs quite significantly. We believe such a decrease in dispersion reduces the risk of BB underperformance relative to HY that would result from a low-quality, beta-led rally in the future.

Exhibit: Dispersion in the High Yield Market

As of 1/31/2025 | Source: Bloomberg

We think BB bonds are now well positioned to deliver alpha over the medium to long term relative to the HY market. Based on our research, we expect them to outperform, especially in an adverse market scenario. 4 In addition, the spread give-up between HY and BBs is near historic lows, making the carry cost of this allocation relatively cheap. Conversely, BBs may underperform during strong risk rallies, as they did last year. However, we think current valuations, including the compressed gap between CCC and BB bonds, coupled with increasing macroeconomic and geopolitical uncertainties, have reduced the probability of this risk. GMO’s High Yield Strategy also has the advantage of the diversifying effect of its other top-down factor exposures to offset some or potentially all of this risk.

Download article here.

Bloomberg Ba U.S. High Yield Index

Fallen Angels are bonds that were issued as investment grade and subsequently downgraded to high yield. They tend to be oversold into the rating transition and recover once downgraded, thus returning to a spread consistent with their credit quality.

In managing the GMO High Yield Strategy, we adhere to certain factor weight ranges based on opportunity set and liquidity considerations. Allocations to the Quality factor (via BB bonds) may vary from 0% to 30%.

When the HY market excess return is negative, the average monthly excess return for BBs is -1.6% while the average monthly excess return for the HY Index is -2.0% (based on the period from 2001-2024).

Disclaimer: The views expressed are the views of Rachna Ramachandran and Mina Tomovska through the period ending March 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

Bloomberg Ba U.S. High Yield Index

Fallen Angels are bonds that were issued as investment grade and subsequently downgraded to high yield. They tend to be oversold into the rating transition and recover once downgraded, thus returning to a spread consistent with their credit quality.

In managing the GMO High Yield Strategy, we adhere to certain factor weight ranges based on opportunity set and liquidity considerations. Allocations to the Quality factor (via BB bonds) may vary from 0% to 30%.

When the HY market excess return is negative, the average monthly excess return for BBs is -1.6% while the average monthly excess return for the HY Index is -2.0% (based on the period from 2001-2024).