Overview

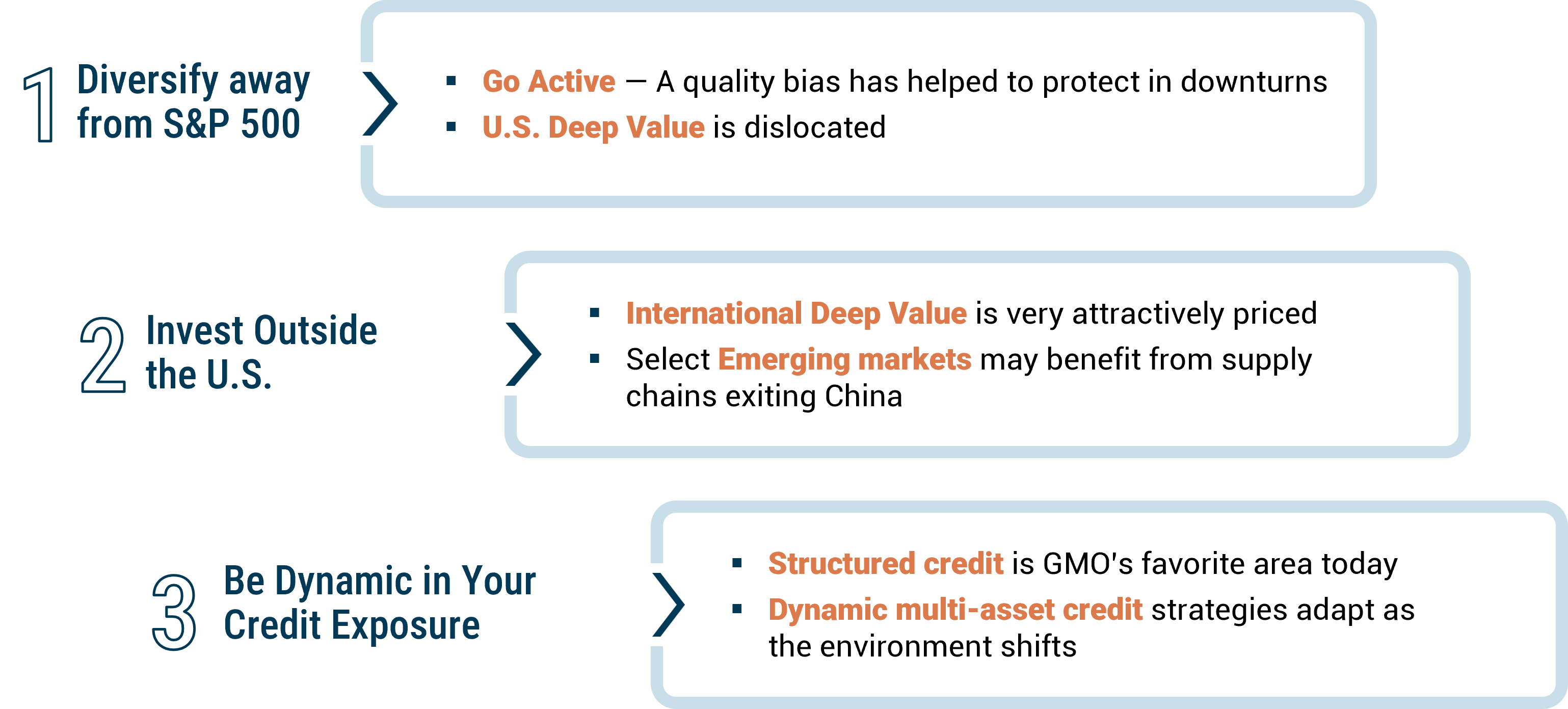

In this webcast, GMO’s Joe Auth, Arjun Divecha, and Ben Inker discussed the macroeconomic outlook and geopolitical landscape as well as the state of global markets. The imminent change in political administration contributes to macro and market uncertainty. In this environment, we recommend investors seek diversification. Today, we find many assets which are priced with a sufficient margin of safety such that they are robust to multiple forward-looking scenarios. Joe, Arjun, and Ben highlighted specific opportunities in pockets of global equities, rates, and structured credit.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

2025 Outlook: portfolio ideas for consideration

Q&A Highlights

Below are select participant questions answered live during the webcast. Please refer to the event replay for full Q&A.

What is your view on U.S. stocks given the potential policies of the incoming administration?

If the agenda largely gets through, there are going to be some good things for the equity market and some bad, but there is a lot of uncertainty about what's going to happen. The fascinating thing is if you look at the markets today, the markets appear to be extremely certain. The U.S. is trading at a bigger premium to the rest of the world than it ever has. 2025 is very likely to be a year with plenty of surprises.

When you have a year of uncertainty, when you have a year where things are unlikely to go exactly as planned, we think what you want to do is have a very diversified portfolio and have your portfolio bias towards assets which are not priced for the best possible outcome.

Is there a scenario where credit spreads can tighten even further in 2025?

We certainly think spreads are tight. Fundamentals are fine, but they don’t support spread levels where they are now. Really there are two things that could keep this going. There are yield buyers and spread buyers. At GMO, we're spread buyers. We don’t like investment grade corporates at 80 bps spread because historically, at these levels, return over the next year is almost always worse than owning the same duration Treasury bond. The yield buyer recognizes that IG corporates rarely default and is content to let the bond mature. The yield buyer base has become much bigger, and if that buyer base keeps growing, it could be a source for investment grade credit spreads continuing to tighten from here. Another possible reason is supply-demand dynamics – if the supply of Treasuries grows faster than that of riskier bonds, that could also cause further tightening.

To make the most of credit markets, we advise being dynamic and nimble, so you are able to capitalize on opportunities and dislocations as they arise.

What’s the outlook for China?

China is bifurcated: you've got a very weak domestic economy and a very strong export economy. Most observers have been somewhat disappointed by the lack of demand stimulus from the Chinese government. The flip side is that even though imports to the U.S. have dropped, China still has record trade surpluses as they're selling more stuff to the rest of the world than they ever did before. The parts of the economy which are doing really well are autos, solar, specific minerals technology, and AI.

From an investment point of view, we don't think China is uninvestable. We think that you just have to be very selective about where you invest.

INVESTMENT IDEAS HIGHLIGHTS

Ben, Arjun, and Joe each shared a favorite investment idea that is well positioned for the year ahead.

Ben Inker: International Deep Value

“We don't think you want to put all of your eggs in one basket, but one of the eggs we really quite like right now is developed ex-U.S. deep value stocks. Non-U.S. stocks are trading at the biggest discount to the U.S. that we’ve ever seen. Further, deep value, the cheapest 20%, are today trading at the 7th percentile versus history. This group is cheaper than they were even in the TMT bubble. This is a really interesting place to own companies that are trading at about book value, single digit forecast PEs, dividend yield of about five with pretty good quality and nice diversification. So, this is a group of stocks we are quite bullish on. They deserve to give returns of 8, 10, even 12%, and they're priced in such a way that you don't need a particularly good outcome to get that.”

Arjun Divecha: Emerging Equities Beyond China

“My idea is targeting countries that are benefiting from supply chains moving out of China. As an example, Apple is moving 25% of its iPhone production to India from China. For India to take just 10% of China's electronics and high-tech exports, it would have to expand its capacity by 850%. Even taking 10% of China’s exports represents a massive opportunity for every one of these other countries (e.g., Vietnam, Mexico, Thailand). We see this as really an interesting place to be - this is a secular transition, so there is a long tail of money to be made here.”

Joe Auth: Commercial Mortgages (with high office exposure)

“We actually like buying and owning commercial mortgage-backed security bonds that have a high percentage of office loans in them. We are very aware of the embedded risks in the office market currently. But when we buy the top bond in a CMBS capital structure, we think those bonds have basically no risk of principal loss no matter what the mix of property types are, and right now you can earn roughly 40 to 50 basis points more for buying a bond with more office exposure than a typical pool. In a market where it's very difficult to get meaningful extra spread without taking real fundamental risk, that is pretty attractive.”

Download event highlight here.