While equity styles go in and out of favor, high-quality equities have proven to be a stable group of exceptional businesses ideally suited to compounding capital and resilient to market drawdowns.

In 2004, GMO launched the Quality Strategy with the mandate to own attractively valued stocks within the quality universe. The creation of the strategy was the culmination of decades of GMO research on quality business models. While the strategy’s origins date back to GMO’s earliest days, our process continues to evolve to ensure sustained relevance as well as our investment edge.

The GMO Quality Strategy is an ideal core equity holding that has delivered strong returns, stability, and risk mitigation for investors for 20 years and counting. In recent years, we’ve successfully extended our differentiated approach to other universes, including defensive equity/absolute return, small caps, and global value.

Suite of GMO Quality Strategies

Quality(2004) |

Quality Spectrum(2019) |

Small Cap Quality(2022) |

Quality Cyclicals(2020) |

|

Thesis |

Flagship long-only strategy; global or U.S. domiciles; seeks to deliver superior return at lower volatility than the broader market |

Enhance the risk mitigation by balancing quality with a “junk” short ~175/75 |

Exploit the superior outperformance of quality stocks within small caps |

The highest quality cyclicals have strong fundamentals across the cycle, yet are discounted for short-term volatility |

Style |

Core | Defensive equity, absolute return | U.S. small cap | Global value |

Common Benchmarks |

S&P 500, MSCI World |

50% MSCI ACWI/50% Cash, MSCI ACWI |

S&P 600 or other small cap index | MSCI ACWI |

Number of Positions |

40-50 | 40-50 long, 300+ short | 40-50 | 40-50 |

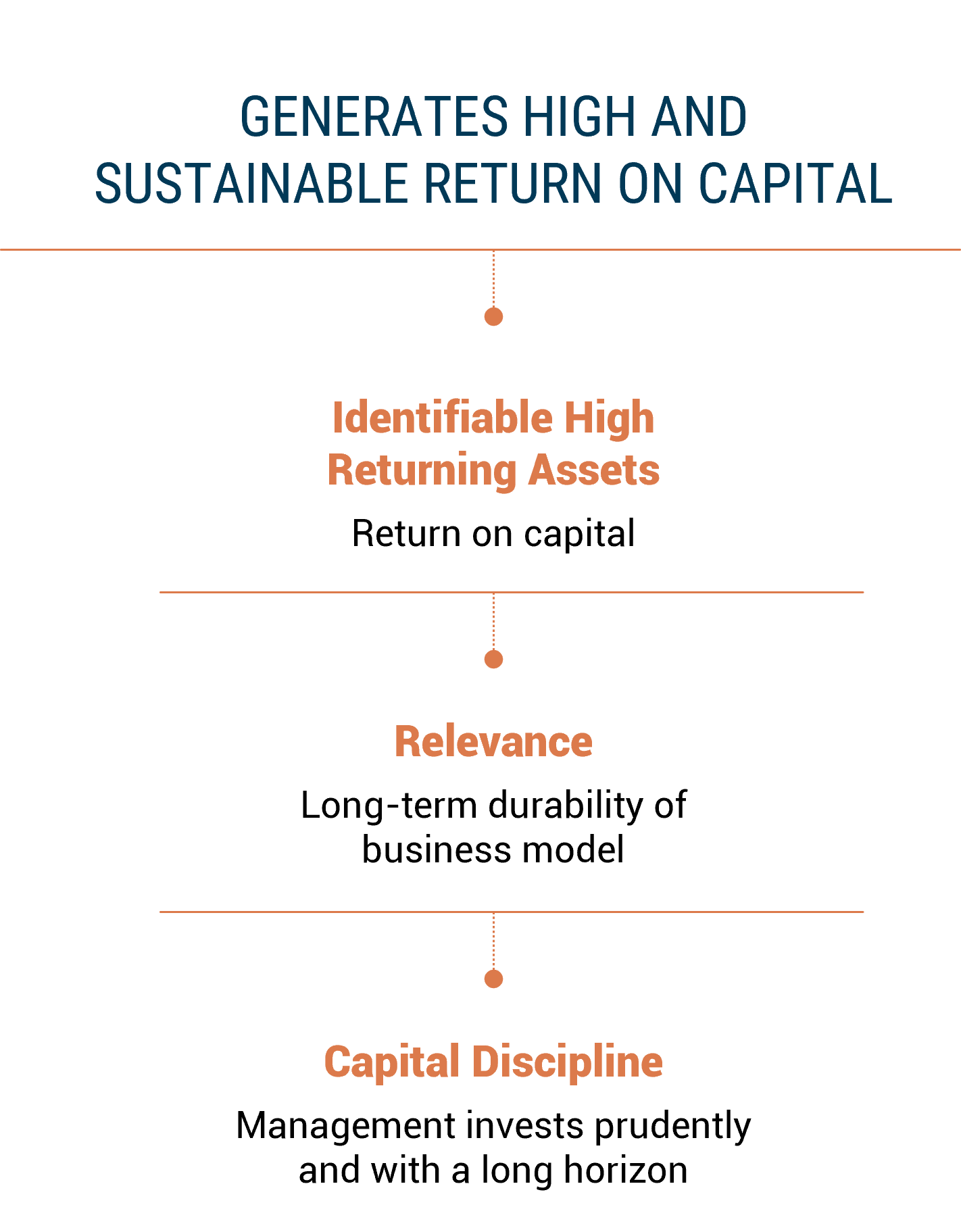

How We Define a Quality Business