Remember when the four most dangerous words in investing were "This time it's different”? Well, this time is truly different. We are observing a significant shift in global supply chains away from China, presenting a substantial investment opportunity.

What are the reasons behind this shift? They include:

- Concerns regarding a potential China-Taiwan conflict,

- Supply chain disruptions caused by the COVID-19 pandemic,

- Tensions between the U.S. and China,

- The need to reduce dependence on a single supplier, combined with rising

costs in China, and - China's internal challenges, including demographic issues and a shift back to

state control.

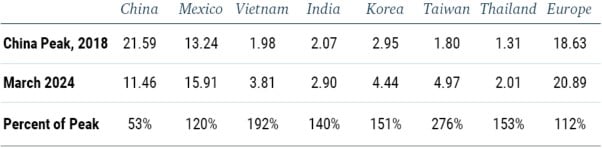

This has led to a substantial realignment of global manufacturing. For instance, Apple is progressing towards its goal of relocating 25% of iPhone production to India. Walmart’s imports from India have increased from 2% to 25% over the past five years, while its imports from China have decreased from 80% to 60%. This is just the tip of the iceberg. Exhibit 1 below summarizes the move across various countries.

Exhibit 1: China’s Share of U.S. Imports Has Fallen Dramatically

Shares of U.S. Imports (%)

As of 3/31/2024 | Source: Federal Reserve Bank, GMO

You might consider this old news, given that terms like “nearshoring,” "friendshoring," and "onshoring" have been popular for years.

When tariffs on Chinese imports were first introduced in 2018, 22% of U.S. imports came from China. This has now dropped to 11%, creating the massive opportunity we now see. Interestingly, very little of this came back onshore, as evidenced by the fact that the U.S. trade deficit has not changed over this period (see Exhibit 2). Furthermore, almost all of the 11% market share that China lost went overwhelmingly to emerging markets, not developed ones.

Exhibit 2: U.S. Onshoring is Not Booming as a Result

U.S. Trade Balance

As of 12/31/2024 | Source: U.S. Federal Reserve

However, the key point is that investors are now acting on these trends. Emerging Markets ex-China ETFs have grown to over $16 billion in assets within just two years. With Mr. Trump back in office, we see renewed actions against China. Coupled with a seemingly moribund Chinese economy, this trend is likely to continue.

At GMO, we have anticipated this trend. Our flagship Emerging Markets Strategy has been slightly underweight China since 2021, 1 and we launched our Emerging Markets ex-China Strategy in 2022.

And now we're taking it a step further with our new Beyond China Strategy.

Here's our thesis: This isn't just about avoiding China. It's about identifying the countries, sectors, and companies that are benefiting from this secular shift.

Our approach involves the following steps.

Step 1: Pick the Right Countries

We at GMO have been doing top-down country allocation in emerging markets equity for over 30 years. In our analysis, we look at six key factors to decide which countries are most attractive:

- Demographics: a young, growing workforce

- Cost Competitiveness: affordable labor with good productivity

- Infrastructure: can they actually ship stuff

- Macroeconomics: is the economy heading in the right direction

- Trade Momentum: is there evidence of exports increasing

- Reasonable Valuations: but of course…

Based on these criteria, countries such as Vietnam, Mexico, India, Thailand, and Indonesia emerge as strong candidates. No surprises there – these are the names you hear every time someone talks about moving production out of China.

Exhibit 3: Most and Least Attractive Countries

Step 2: Identify the Right Sectors and Themes

This is where it gets interesting. We're not just buying the index in these countries. We focus on the sectors that we believe will benefit most from this shift, such as:

- Industrial real estate and ports in Vietnam and Mexico,

- Tech services in India, leveraging the digitization trend, and

- Consumer plays in Southeast Asia.

But we're going beyond just sectors. We look at overarching themes that capture the essence of this shift, including:

Economic growth from nearshoring,

- Market share gains from Chinese competitors,

- Global capex boom on the back of AI realignment, and

- Electric vehicles and renewables supply chain.

This thematic approach allows us to build a portfolio that reflects the key drivers of the Beyond China trend, rather than making large bets on individual stocks.

Step 3: Pick the Right Stocks

We maintain our value discipline by seeking high-quality companies at reasonable valuations. Our stock selection models, refined over decades, help us identify the most attractive companies within these themes.

The result is a portfolio of up to about 100 stocks that we believe are well-positioned to benefit from this significant change.

Managing Current Risks through Active Management

Recent political developments create new complexities but also contribute to this opportunity. We do not expect to see less policy uncertainty in the coming years. Therefore, we diversify across countries and themes and remain flexible to pivot as geopolitical and economic conditions change. This is why our strategy is actively managed, not passive.

We're offering this strategy via separate accounts and in an ETF format – the GMO Beyond China ETF (NYSE: BCHI) – for easy access for institutional and individual investors. It's benchmark-agnostic (though we use the MSCI Emerging Markets ex-China Index for performance comparison), which gives us the flexibility to go where we believe the opportunity is greatest.

It is important to note that this strategy is not an anti-China play. We still see opportunities in China, and our flagship Emerging Markets Strategy maintains exposure there. The Beyond China Strategy is designed for those seeking targeted exposure to the beneficiaries of this supply chain shift while managing their China risk separately.

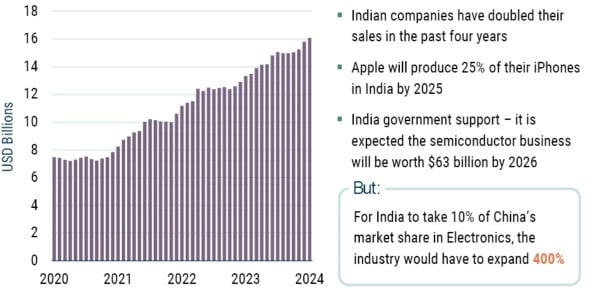

And lest you think this is a short-term opportunity, let us illustrate the long-term potential. In 2022, China’s exports of electric and electronic goods totaled $1.1 trillion. For India to capture just 10% of this market share, it would need to export $110 billion. In 2022, India’s exports in this sector were $26 billion. Therefore, India’s electric and electronics sector would need to quadruple to take 10% market share from China. This applies to all manufactured goods across various sectors.

Exhibit 4: India – We’ve Only Just Begun…

India Electronics and Electricals Sales

As of 8/31/2024 | Source: GMO, Worldscope, Thomson Reuters, Compustat

The good news is that despite the size of the opportunity, this theme has not been overbid. Valuations remain quite reasonable, in our view, especially compared to U.S. standards.

In conclusion, we believe we are at the beginning of a multi-year, possibly multi-decade, trend that will reshape the global economy. The GMO Beyond China Strategy aims to capture this opportunity by combining our robust top-down approach with thematic insights and rigorous stock selection.

Download article here.

24.2% China exposure for the GMO Emerging Markets Strategy compared to 27.8% for the MSCI Emerging Markets Index as of December 31, 2024

Past performance is no guarantee of future results.

An investor should carefully consider the fund’s investment objectives, risks, charges and expenses before investing. This and other important information can be found in the fund’s prospectus. To obtain a prospectus please visit www.gmo.com. Read the prospectus carefully before investing.

Risks associated with investing in the Fund may include: (1) Market Risk - Equities: The market price of equities may decline due to factors affecting the issuer, its industries, or the economy and equity markets generally. Declines in stock market prices generally are likely to reduce the net asset value of the Fund's shares. (2) Non-U.S. Investment Risk: The market prices of many non-U.S. securities (particularly of companies tied economically to emerging countries) fluctuate more than those of U.S. securities. Many non-U.S. markets (particularly emerging markets) are less stable, smaller, less liquid, and less regulated than U.S. markets, and the cost of trading in those markets often is higher than it is in U.S. markets. (3) Currency Risk: Fluctuations in exchange rates can adversely affect the market value of the Fund's non-U.S. currency holdings and investments denominated in non-U.S. currencies. For a more complete discussion of these risks and others, please consult the Fund's Prospectus. The GMO ETFs are distributed in the United States by Foreside Fund Services LLC. GMO and Foreside Fund Services LLC are not affiliated.

Disclaimer: The views expressed are the views of Arjun Divecha and Warren Chiang through the period ending February 13, 2025, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

24.2% China exposure for the GMO Emerging Markets Strategy compared to 27.8% for the MSCI Emerging Markets Index as of December 31, 2024