Overview

GMO’s Multi-Asset Credit Strategy builds on the firm’s 30-year history managing fixed income solutions on behalf of institutional and financial intermediary clients by utilizing a combination of fundamental and quantitative investment approaches.

Anchored by our valuation-driven philosophy, the GMO Multi-Asset Credit Strategy dynamically allocates across fixed income markets including emerging debt, structured products, high yield and investment grade credit, loans, and mortgages.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- Driven by relative value opportunities, we believe our investment team’s flexible and nimble approach allows us take advantage of relative value opportunities without being impeded by a bureaucratic structure.

- About one-third of the Strategy’s alpha is expected from top-down implementation with about two-thirds of alpha generation expected from underlying alpha engines.

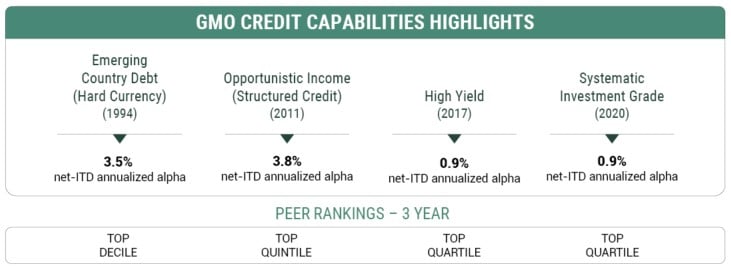

GMO CREDIT Alpha Engines

Time-tested, unconventional, value-driven approach to investing in credit

As of 6/30/2024

Past performance is not a guarantee of future results.

Limitations of Simulated Model Performance. The performance presented reflects simulated model performance an investor may have obtained had it invested in the manner shown and does not represent performance that any investor actually attained. The simulated model performance presented is based upon the methodology discussed in the paper. No representation or warranty is made as to the reasonableness of the methodology used or that all methodologies used in achieving the returns have been stated or fully considered. Simulated model returns have many inherent limitations and may not reflect the impact that material economic and market factors may have had on the decision-making process if client funds were actually managed in the manner shown. Actual performance may differ substantially from the simulated model performance presented. Changes in the methodology may have a material impact on the simulated model returns presented. There can be no assurance that GMO will achieve profits or avoid incurring substantial loss.

- The Strategy utilizes a balanced approach to risk and return by focusing on capital preservation during market downturns and avoiding premium-priced securities in overvalued markets.

Download highlights here.