Executive Summary

War, inflation, rising rates, banking chaos, and recession are among the challenges facing markets. Investors must balance these shorter-term risks with the long-term return prospects of equities. Quality stocks have both outperformed over the long haul and protected during market drawdowns, making them uniquely suited for this type of environment. For investors interested in even more downside protection, we’ve launched a long/short strategy that exploits the stability of attractively valued high-quality stocks and the instability of expensive low-quality stocks.

Introduction

The current investment environment is fraught with peril. Geopolitical instability and domestic political conflict form the backdrop for an economy beset by inflation, rising rates, a festering banking crisis, and slowing growth. Most economists expect a recession, though timing, severity, and length are unknowns. Yet, valuations remain rich for many asset classes.

In such an environment, investors must consider how best to pursue the long-term returns of equity markets given these shorter-term risks. At GMO, we have a long history of Quality investing and view this as the type of environment in which Quality companies not only survive but typically strengthen their business models for the long term. In this letter, we extol the virtues of Quality while warning of some implementation pitfalls. In addition, we discuss our relatively new long/short Quality strategy, which we expect to provide even more downside protection than long-only Quality while still delivering strong returns. This long/short implementation may prove particularly valuable in the environment that lies ahead.

The backwardation of risk 1

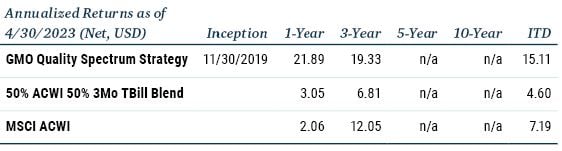

It is an investment axiom that seeking higher returns requires taking more risk. In fixed income markets, for example, high yield (junk) bonds have returned more than lower risk investment grade securities. In equity markets, however, higher-quality stocks have outperformed lower-quality (junk) stocks by a considerable margin despite being much less risky (see Exhibit 1). This is akin to getting a Mercedes on the cheap and paying up for a Yugo! 2

Exhibit 1: The bond market prices risk rationally, but the stock market gets it backwards

Finance theory tell us that high-risk stocks should win…but they don’t

As of 12/31/2022 | Source: S&P, MSCI, GMO

GMO defines Quality companies as those with high profitability, low profit volatility, and minimal use of leverage. Junk companies are the inverse. See Endnotes for further information regarding benchmark data presented..

The lower market volatility of Quality stocks is a reflection of their more stable fundamentals. This stability allows Quality companies to make strategic investments during times of economic stress, while Junk companies fight for their lives. The tendency for Quality to hold up relatively well while Junk falls apart during downturns will be important when we discuss our long/short strategy later.

The origins of Quality at GMO

The observation that Quality stocks have compelling risk/return characteristics has been at the core of GMO’s equity investing since our early days. When Jeremy Grantham and his partners founded the firm in the late 1970s, Jeremy and his colleagues 3 grappled with the conundrum that high quality businesses (e.g., Johnson & Johnson, Procter & Gamble, The Coca-Cola Company) were difficult for Value investors to own because they tended to trade at a premium to the market on traditional Value measures, such as price to book. Yet, at the same time, the great companies had both outperformed over the long haul and protected capital in prolonged downturns. Jeremy recognized that a framework that enabled an investor to determine the relative quality of business models would help determine a truer sense of the intrinsic value of those companies.

Quality companies tend to have sustainable competitive advantages that allow them to be excessively profitable for decades at a time. Our research led to three keys in identifying companies that enjoy these edges. Companies with a record of high profitability, stable profitability, and low leverage are most apt to be able to continue to grow by deploying capital at high rates of return throughout the business cycle and in various economic environments. By incorporating these Quality factors into GMO’s early Value models, GMO held great businesses trading cheaply relative to their Quality-Adjusted Intrinsic Value.

Junk companies, of course, flail around at the other end of the spectrum, producing low, unstable profitability despite the assistance of a substantial dose of leverage. Junk companies generally lack sustainable competitive advantages and are reliant on favorable conditions for success. They may be levered to the economic cycle or reliant on easy credit conditions. They may be pursuing an unproven medicine or technology, or they may be overseeing businesses in declining industries. There are various flavors of Junk companies, but they share vulnerability in the face of adverse events. While a glancing punch can knock a Junk company to the mat, Quality companies absorb body blows like Rocky Balboa and come back for more.

Why have Quality stocks outperformed?

At this point, it should be clear how odd it is that Quality wins. Much academic ink has been spilled on the Quality anomaly, and research written by investment professionals abounds. Most explanations fall within a broad, behavioral-based thesis. Studies posit that analysts and investors systematically underestimate the future returns of high-quality firms compared to low-quality firms. Put another way, investors routinely overpay for the exciting lottery ticket prospects of speculative, junky business models while neglecting the tangible but boring attributes of Quality stocks.

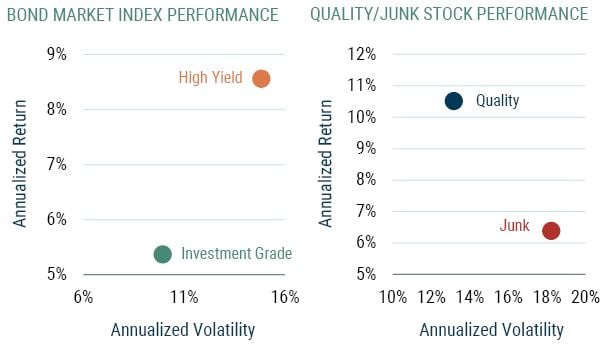

We see another important behavioral factor at work, and it revolves around the impact of career risk on investment decision making, a favorite topic at GMO. Investors typically expect the market to rise. After all, the market has risen in 74 of the last 100 years. Given the general expectation of rising markets and the awareness that Quality tends to trail in up markets (see Exhibit 2), it’s easy to see why it can feel risky to allocate to Quality when focused on relative performance. Of course, Quality more than claws the performance back through dramatic outperformance in down markets (once again, see Exhibit 2), leading to the outperformance of Quality over time. Slow and steady wins the race, but at the end of the quarter, it’s hard to ignore the pernicious whisper of the relative-return-oriented “Why do you lose more often than not?” Compounding over time does get noticed but is an excruciatingly slow route to fame and fortune. 4

Exhibit 2: Why Do Quality Companies Outperform?

Relative risk drives investor behavior, and Quality companies trail in up markets

Data from 1/31/1988 to 3/31/2023 | Source: MSCI, GMO

GMO defines Quality companies as those with high profitability, low profit volatility, and minimal use of leverage. Junk companies are the inverse. See Endnotes for further information regarding benchmark data presented.

GMO’s approach to Quality

Two key elements drive the investment approach for our Quality Strategy. First, we must accurately assess the quality of the business. This is easier said than done. In 2022, the MSCI USA Quality index significantly underperformed in a big down market, not what investors expect when they invest in Quality. Our experience indicates that the optimal approach to assessing Quality requires a blend of fundamental and quantitative analysis. Employing quantitative models to identify companies with Quality characteristics is a good place to start, and we have a high degree of confidence in our own models targeting the key criteria that Jeremy Grantham and his colleagues came up with decades ago. However, even the best models can produce both false positives and false negatives. As such, we augment our metrics with fundamental industry and company research. For example, Bed Bath & Beyond screened as a higher-quality company than Apple until 2015. We did not make that mistake in our Quality Strategy.

Once we’ve completed our Quality assessment, we move on to the second key: determining fair value. The best Quality assessment, quantitative or fundamental, cannot protect against the risk of overpaying, and we believe that a price-sensitive approach significantly enhances return and improves performance during market drawdowns. Many strategies designed to provide stable, low-risk equity returns, ranging from low volatility portfolios and Quality factor portfolios to concentrated active Quality portfolios, suffer from valuation ignorance or agnosticism. 5 On our measures, Quality did not protect significantly during the bursting of the tech bubble. Microsoft was a high-quality company then as now, but in those days traded at over 50x earnings. We saw an echo of that in 2022 when again high-quality growth companies at stretched valuations lagged. Many “Quality” portfolios were revealed to be concentrated in Growth at any price and hence underperformed in the down market. We believe that a more prudent approach integrating valuation is key both for risk reduction and generating absolute returns.

Adding Junk to the mix

The GMO Quality Strategy has successfully exploited the market inefficiency we’ve been discussing by outperforming while delivering better drawdown protection and fundamental strength over time. Our strategy has successfully stayed close to or even beaten broad equity markets during up periods while outperforming in down periods, a profile that has proven very useful for allocators. However, let’s look at the less well exploited opportunity at the other end of the spectrum: Junk. Junk stocks not only underperform, but they do so with higher volatility and particularly struggle when times get tough. Hence, Junk companies are interesting candidates for shorting in general and can additionally hedge against economic risk. A long Quality/short Junk portfolio with material net long exposure can compound over time with significantly more downside protection than even a long-only Quality strategy, let alone compared to broad equity indices. Today, surveying an investment landscape strewn with unproven and unprofitable business models buoyed by years of easy money seems like an opportune time to take advantage of the full range of Quality.

We saw a similarly exciting landscape for shorting Junk in 2004 when we launched a long Quality/short Junk strategy called Tactical Opportunities. The objective was to harvest the Quality-Junk spread and provide a cost-effective hedge for equity risk. The “Tactical” in the strategy’s name denoted that we saw unusual return potential at the time given the valuation gap between high- and low-quality stocks (much like we have in the post-Covid years with GMO’s Equity Dislocation Strategy, focused on Value vs. Growth). The Tactical Opportunities Strategy was dollar neutral, and the higher volatility of our short book relative to our long book typically resulted in significantly negative beta. Once the tactical opportunity played out (as it did spectacularly well in 2008), the portfolio reverted to a narrower use case as efficient tail risk protection. 6

The rise of Quality Spectrum

A cheap hedge/tactical bet is one thing, but we’ve long been excited about the idea of capitalizing on the features of Quality and Junk in a strategic all-weather portfolio. In 2019, we did just that with the launch of the Quality Spectrum Strategy. Quality Spectrum employs the same ingredients as the Tactical Opportunities Strategy. However, as opposed to the dollar neutral implementation of Tactical Opportunities, Quality Spectrum is net long. A net long Quality/Junk portfolio results in a positive beta and can generate strong returns across periods, transforming a tactical hedging portfolio into a long-term compounding vehicle with excellent risk-adjusted returns.

In determining our gross and net leverage levels, we considered three key objectives:

- Deliver strong returns over time…the stronger, the better.

- Target an acceptable level of absolute volatility, which we construe as being roughly in line with equity markets.

- Provide material downside protection relative to equity markets, perhaps more comparable to hedge fund indices.

Our research indicated that a long 175%/short 75% blend balanced these objectives quite well. The long side of the portfolio mirrors the implementation of our long-only Quality Strategy – a concentrated, fundamentally driven, valuation sensitive portfolio. The short side is more diversified in construction, dialing into a broad basket of expensive Junk companies. While we believe that expensive Junk is fertile ground for identifying excellent short opportunities and that this group will perform poorly during downturns when we need it to, we also recognize the importance of managing idiosyncratic risk on the short side. Just in the last three years, we’ve seen any number of companies rally hundreds of percent, only to subsequently fall over 90%. It’s tough to be on the wrong side of those rallies, even if only for a time. By shorting a diversified basket, we focus on capturing the Junk factor without taking undue risk on individual names.

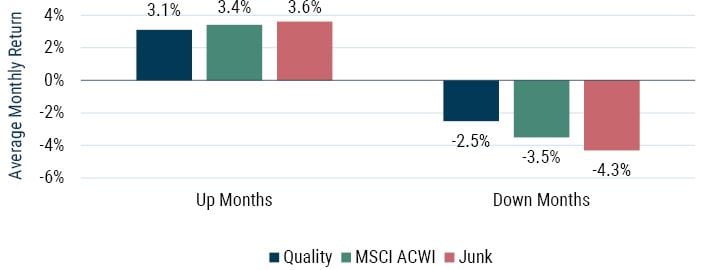

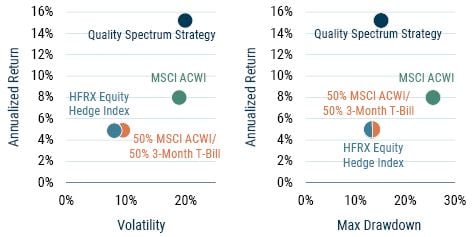

Beyond theory – Quality Spectrum in practice

Thus far, we’ve focused on our thesis and long history of experience with Quality and Junk investing, but how has the Quality Spectrum Strategy performed in practice? To date, we’ve accomplished our key objectives as well as we could have hoped (see Exhibit 3). Since inception, the Quality Spectrum Strategy has delivered returns of around 15% per annum net of fees, outperforming the broad market by almost 8% per annum despite its low beta. 7 As expected, the volatility of the strategy has been in line with the market; however, volatility is a poor proxy for “true” risk. While drawdowns aren’t perfect measures of risk either, we believe drawdowns are a better reflection of the safety of a strategy, and the drawdowns for Quality Spectrum have been much smaller than those of the market. The maximum drawdown of the strategy has, in fact, been perhaps its most impressive feature. Despite delivering equity plus returns, our maximum drawdown has been more in line with hedge fund indices and our official benchmark, which has 50% cash! 8

Exhibit 3: Strong returns with lower true risk

Battle-tested through wild markets since inception: Covid, epic Growth rally/collapse, inflation, rising rates, recession

As of 4/30/2023 | Inception: 11/30/2019 | Source: MSCI, J.P. Morgan, GMO

See Endnotes for further information regarding performance and benchmark data presented.

While three and a half years isn’t a particularly long period of time, the Quality Spectrum Strategy has been battle-tested through a variety of different environments and has nimbly navigated a minefield of challenges, including Covid, an epic Growth rally in 2020 when interest rates were slashed to zero (no small feat when you’re short growthy Junk), inflation, war in Ukraine, recession, rising rates, and a banking crisis. When combined with our research and two decades of experience investing in Quality and shorting Junk, we feel confident in the strategy’s prospects going forward.

Beta that moves when you want it to

In designing Quality Spectrum, our research indicated a long-term beta expectation of around 0.4 to 0.5. From inception through the end of April 2023, the beta has been closer to 0.7 in a market that jumped almost 50%. Yet, when the market dropped almost 20% in 2022, Quality Spectrum fell less than 2%. This is due to one of the most attractive features of the strategy: the beta tends to rise in up markets and fall in down markets without the need for investment decision making or market prognostication. Why? Typically, when the market is under duress, the beta of the long Quality book drops while the beta of the short Junk book rises significantly, resulting in a substantial reduction in beta. The opposite generally occurs when markets are rushing upwards: the beta of the long book rises while the beta of the short book drops, leading to an increase in beta. As portfolio managers, it’s a luxury to be able to trust your portfolio to do the right thing as conditions change!

Challenges of long/short Quality

We aren’t the only investors to note the benefits of a net long portfolio with a levered long book of low volatility stocks complemented by a smaller short book of higher volatility stocks. However, we may be the first to bring a focus on both fundamentals and valuation to such an approach. Strategies that only target statistical measures of volatility lack transparency, tending to exhibit significant time-varying style and sector exposures, often with abrupt rotation at inopportune times. In addition, a pure low volatility approach tends to miss compounding opportunities on the long side and can mistake high duration for fundamental risk on the short side. Quality Spectrum is designed to overcome these challenges.

Perhaps the biggest challenge in allocating to Quality Spectrum surrounds difficulty of fit. The return potential compares favorably with long-only equities, but strategies with short exposure can be eyebrow raising for a long-only program. Furthermore, the beta lies somewhere between equities and hedge funds, making it a tough fit for either basket. For creative allocators who can find a spot in their portfolio, we continue to be as excited as ever about the long/short approach.

Conclusions

While risks to the economy continue to pile up, we don’t pretend to know how any of them will play out. However, we do believe that truly high-quality companies at attractive valuations will protect investors through the inevitable storms and compound returns at superior levels for the long term.

Furthermore, a long/short portfolio that additionally exploits underperforming junk companies can provide even more downside protection while also delivering strong returns. The enhanced downside protection of the long/short approach emanates from the tendency for low-quality companies to fall apart when things get tough while high-quality companies persevere, leading to a falling beta in down markets. Despite the unusually attractive features of our long/short implementation, the strategy does not fit neatly into a bucket and thus isn’t a popular strategy for investors and, hence, for asset managers to offer. We are hopeful that this barrier to entry for the strategy will allow it to continue to work, as we think the strategy represents an excellent opportunity for those creative enough to rearrange their buckets!

Download article here.

We are adhering to GMO jargon here. One of the original architects of the GMO Quality Strategy, Chuck Joyce, used this phrase to describe the phenomenon that Quality stocks outperform with lower risk.

Yugo was a 1980s automobile brand that many consider to be a strong competitor for the illustrious “Worst Car in History” title.

Some of the early GMO investors who contributed to this thinking include Chris Darnell and Forrest Berkley, among others.

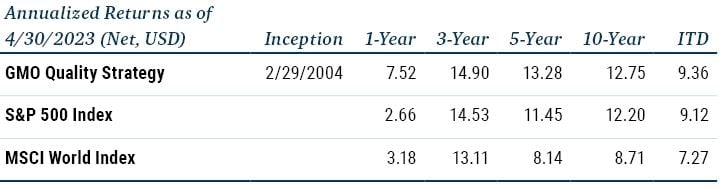

To be clear, Quality’s tendency to lag in up markets doesn’t mean that one should avoid Quality in a bull market. In an up market over the five years through April 30, 2023, for example, our Quality Strategy has delivered 13.5% net of fees per annum vs. 11.5% for the S&P 500 and 8.1% for MSCI World.

“Quality: The Real McCoy,” Kim Mayer, GMO Focused Equity Insights, November 2020.

You may have noted that we are using the past tense here. Negative beta is a difficult thing to chew on given the upward trend in markets, and that particular implementation of a Quality long/short proved to be a difficult line item to hold within an investment program. It required dynamic sizing to be effective as a puzzle piece performing a specific hedging role and often produced ugly results when considered in isolation. While this is still a theoretically interesting tool, GMO retired the dollar neutral strategy a few years ago.

The broad market here refers to the MSCI All Country World index (MSCI ACWI). Performance data is as of April 30, 2023.

The official benchmark for the GMO Quality Spectrum Strategy is 50% MSCI ACWI/50% 3-Month T-Bills.

Endnotes

Exhibit 1 bond indices are the S&P 500 High Yield Corporate Bond index and the S&P 500 Investment Grade Corporate Bond index. The S&P 500 Investment Grade and High Yield index return data starts in 1995. The Quality and Junk portfolios in Exhibits 1 and 2 are based off the MSCI ACWI index returns that start in 1988. High- and low-risk groups are based off quartiles within the MSCI ACWI index.

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. S&P does not guarantee the accuracy, adequacy, completeness, or availability of any data or information and is not responsible for any errors or omissions from the use of such data or information. Reproduction of the data or information in any form is prohibited except with the prior written permission of S&P or its third-party licensors. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

Risk Disclosure

Risks associated with investing in the Strategy may include: Market Risk - Equities, Management and Operational Risk, Focused Investment Risk, Non-U.S. Investment Risk, and Currency Risk.

Risk Disclosure

Risks associated with investing in the Strategy may include: Equities Risk, Short Investment Exposure Risks, Focused Investment Risk, Currency Risks, and Smaller Company Risks.

Performance data quoted represents past performance and is not predictive of future performance.

Net returns are presented after the deduction of a model advisory fee and incentive fee if applicable. These returns include transaction costs, commissions and withholding taxes on foreign income and capital gains and include the reinvestment of dividends and other income, as applicable. Fees paid by accounts within the composite may be higher or lower than the model fees used. A Global Investment Performance Standards (GIPS®) Composite Report is available on GMO.com by clicking the GIPS® Composite Report link in the documents section of the strategy page. GIPS® is a registered trademark owned by CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Actual fees are disclosed in Part 2 of GMO's Form ADV and are also available in each strategy’s Composite Report.

Disclaimer: The views expressed are the views of Tom Hancock and Lucas White through the period ending May 2023, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2023 by GMO LLC. All rights reserved.

We are adhering to GMO jargon here. One of the original architects of the GMO Quality Strategy, Chuck Joyce, used this phrase to describe the phenomenon that Quality stocks outperform with lower risk.

Yugo was a 1980s automobile brand that many consider to be a strong competitor for the illustrious “Worst Car in History” title.

Some of the early GMO investors who contributed to this thinking include Chris Darnell and Forrest Berkley, among others.

To be clear, Quality’s tendency to lag in up markets doesn’t mean that one should avoid Quality in a bull market. In an up market over the five years through April 30, 2023, for example, our Quality Strategy has delivered 13.5% net of fees per annum vs. 11.5% for the S&P 500 and 8.1% for MSCI World.

“Quality: The Real McCoy,” Kim Mayer, GMO Focused Equity Insights, November 2020.

You may have noted that we are using the past tense here. Negative beta is a difficult thing to chew on given the upward trend in markets, and that particular implementation of a Quality long/short proved to be a difficult line item to hold within an investment program. It required dynamic sizing to be effective as a puzzle piece performing a specific hedging role and often produced ugly results when considered in isolation. While this is still a theoretically interesting tool, GMO retired the dollar neutral strategy a few years ago.

The broad market here refers to the MSCI All Country World index (MSCI ACWI). Performance data is as of April 30, 2023.

The official benchmark for the GMO Quality Spectrum Strategy is 50% MSCI ACWI/50% 3-Month T-Bills.