In a world of rich valuations and heightened geopolitical uncertainties, we believe Japanese equities are well positioned to deliver attractive returns. Yet most investors remain underexposed to Japan with the average international equity mutual fund 6.9% underweight relative to the MSCI EAFE benchmark. 1 We think now is the time to close that gap. In fact, we’d argue it’s time to go further, to consider overweighting Japan, for the following reasons:

- Japan’s exit from deflation improves the macro backdrop

- Corporate reforms crossed a tipping point

- The market offers attractive valuations and strong balance sheets

Exiting Deflation: Improves Macro Backdrop for Companies

Japan suffered decades of slow economic growth stemming from the excesses and malinvestment of the bubble in the late 1980s. The decline in asset prices created a deflationary mindset in Japan and sluggish growth as companies cut wages and investment, consumer confidence fell, and consumption stagnated. Concerted efforts by a new generation of policymakers, regulators, and managers, along with the Covid-induced global inflation surge, have finally helped the Japanese economy reach sustainable inflation.

Rising goods and input prices stemming from Covid have transmitted to upward pressure on wages, a necessary condition to break Japan’s deflationary malaise. Nominal wage growth accelerated to +4.8% for the month of December 2024 relative to the same month a year earlier, which was the largest increase since 1997. At its recent meeting in late January, the Bank of Japan raised interest rates 50 bps to the highest level in 17 years, pointing to “a virtuous cycle between wages and prices continuing to intensify.” Japan’s nominal GDP is estimated to be 3.4% in 2025, up considerably from the 1.6% average from 2013-2019. 2

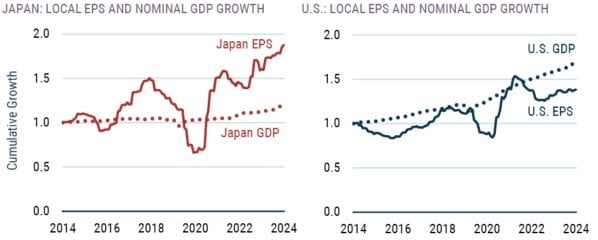

Despite slow real growth over the past decade, Japanese companies have impressively found ways to deliver solid EPS growth. As the chart below indicates, EPS in Japan have grown faster than the underlying economy in nominal terms, which stands in stark contrast to the U.S. where the opposite is true.

Exhibit 1: Japan Delivered Superior Earnings Growth, Despite Anemic Economic Growth

Japanese corporate reforms have led to operational improvements and focus on ROE in last decade

As of 12/31/2024 | Source: GMO, FRED, BEA, Minack Advisors

EPS in local terms for MSCI Japan and MSCI U.S. indexes.

Strong EPS growth in Japan came from improving net margins (due to price increases, offshoring, divesting low margin businesses, etc.) 3 Given the abnormally low level of profitability in Japan, room for additional operational improvements remain widespread. Return to shareholders can also be enhanced through better balance sheet management given Japanese corporate balance sheets remain overcapitalized.

Corporate Reforms: The Environment We’ve Been Waiting For

For years, Japanese corporate managers have been under pressure from government policymakers, regulators, active shareholders, and proxy voting companies to improve the low returns on Japan Inc.’s capital base. Corporate governance reforms seem to have entered a new and accelerated phase recently. Management teams of public companies are more aware and accepting of the need to improve ROEs and returns to shareholders. Buybacks, for instance, increased dramatically in recent years. In 2024, ¥16.8 trillion of share buybacks were pledged – a 75% increase over the prior year.

Other encouraging signs of reform include the intensification in the unwinding of cross holdings and more aggressive change-of-control tactics. Regulatory pressure ignited the wholesale sell-off of cross shareholdings in the insurance sector and even holdouts such as the Toyota Group companies have begun large-scale unwinding of cross shareholdings. In regard to change of control, recent deals, such as Nidec’s $1.6 billion unsolicited bid for Makino Milling Machine, the competitive bidding process for Fujisoft by private equity firms, and Couche-Tard’s $38.5 billion unsolicited bid for 7&i Holdings highlight a significant shift in the norms of such tactics in Japan. An historically insular Japan that hasn’t seen a foreign takeover since 2016 has thrown the doors open to domestic and foreign suitors (well, they’ve at least cracked the door to the active investors recognizing the attractive opportunity).

GMO’s Usonian Japan Equity team has been on the ground investing in and engaging with management teams for over 20 years and has never seen the market for corporate control so active. Unsolicited bids (and supportive regulation) have forced Japanese management teams to adapt in order to enhance their operational efficiency, increase ROE, and improve shareholder communication. In the fourth quarter of 2024, two of the 41 companies in GMO’s Usonian Japan Value Strategy were subject to tender offers at significant premiums. 4

Margin of Safety: Attractive Valuations and Solid Fundamentals

Investing in Japanese equities brings no shortage of risks: broad-based tariffs would slow global growth to which Japan is highly sensitive; U.S. efforts to balance the trade deficit with China could strain Japan’s competitiveness and corporate profits due to increased China competition outside the U.S.; supply chain or trading disruptions with China, whether due to policy changes or military actions, would slow Japan’s economy; and a significant devaluation of the U.S. dollar would negatively impact corporate profits in Japan. 5

Cheap valuations and companies with rock-solid balance sheets provide an important margin of safety to these risks. Furthermore, Japanese companies have diverse export markets and have offshored a significant amount of production out of China, with investment from reshoring benefiting Japan’s competitive position and internal consumption. Most multinational companies, moreover, employ hedging programs to limit the impact of currency fluctuations on their bottom lines.

Despite investor perceptions, Japanese equities have delivered strong local returns over the last decade, driven by the superlative earnings growth mentioned above. While the broad Japanese equity market looks a bit rich, we see attractive pockets of opportunity. Small value stocks in Japan currently measure as one of the most attractive equity markets that we forecast, using GMO’s 7-Year Asset Class Forecasts, given that group trades near one of its widest discounts to the market on record. Small companies also tend to be more domestically focused than the broad market, benefiting from structural improvements while likely being more insulated in the case of a global trade war. Finally, given the yen’s relative cheapness currently against both the U.S. dollar and other major currencies, we think unhedged investors will continue to benefit from yen appreciation over the long run.

High Conviction Reflected in GMO Asset Allocation’s Portfolios

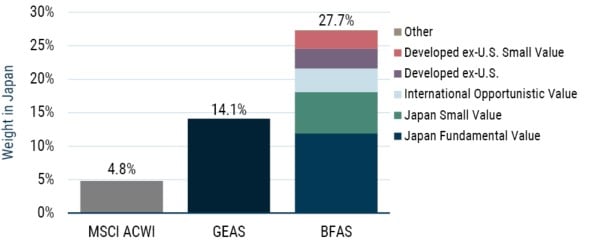

At the end of 2024, in GMO’s Benchmark-Free Allocation Strategy (BFAS), the most flexible, benchmark-agnostic of our multi-asset class strategies, we had nearly 28% of our equity exposure (which represented just over half of the overall portfolio) in Japan versus 4.8% in the MSCI ACWI. Our more benchmark-sensitive Global All Country Equity Allocation Strategy (GEAS), meanwhile, had nearly three times the benchmark’s weight to Japan. We have utilized five distinct portfolios with strong track records and diversifying alpha sources to build these exposures.

Exhibit 2: Benchmark-Free and Global All Country Equity Allocation Strategies Japan Exposures

(As % of overall equity allocation)

As of 12/31/2024 | Source: GMO

Download article here.

Source: GMO, eVestment. Active strategies with MSCI EAFE index as preferred benchmark.

Goldman Sachs, “Japan Portfolio Strategy,” (11/18/2024).

The weak yen also helped the competitive stance of Japan’s exporters over this period.

The team’s deep fundamental analysis and engagement skills have helped improve outcomes for shareholders in some cases by increasing takeover premiums. GMO’s Usonian team also considers active roles in take-private transactions through standalone investment structures.

On the other hand, tariffs or persistent U.S. inflation could certainly pressure U.S. rates upward and lead to yen weakness in the near term. This would detract from unhedged returns but improve the competitive stance of Japanese companies.

Disclaimer: The views expressed are the views of Rick Friedman and John Thorndike through the period ending March 2025 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2025 by GMO LLC. All rights reserved.

Source: GMO, eVestment. Active strategies with MSCI EAFE index as preferred benchmark.

Goldman Sachs, “Japan Portfolio Strategy,” (11/18/2024).

The weak yen also helped the competitive stance of Japan’s exporters over this period.

The team’s deep fundamental analysis and engagement skills have helped improve outcomes for shareholders in some cases by increasing takeover premiums. GMO’s Usonian team also considers active roles in take-private transactions through standalone investment structures.

On the other hand, tariffs or persistent U.S. inflation could certainly pressure U.S. rates upward and lead to yen weakness in the near term. This would detract from unhedged returns but improve the competitive stance of Japanese companies.