Overview

GMO’s Small Cap Quality portfolio managers, Hassan Chowdhry and James Mendelson, discussed why small cap valuations are attractive today and why they believe using quality is a better way of investing in the asset class. A quality lens helps to identify the truly special companies with sustainable competitive advantages and, like large cap quality, has offered protection in down markets.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- GMO’s Focused Equity team applies the same quantitative tools and fundamental analysis used in large cap quality to identify the highest quality companies in the small cap universe with the best forward-looking prospects trading at attractive valuations.

- High-quality small cap companies have outperformed both the small cap market in the U.S. and the broader all-cap U.S. market over time.

- Small cap underperformance over the last decade has been driven by valuation decline; fundamentals have been strong. Small cap companies have actually grown earnings faster than large cap companies over the period.

- Relative performance between large and small cap stocks has been cyclical throughout history. Small cap valuations are now much cheaper than large caps, after starting the decade much more expensive.

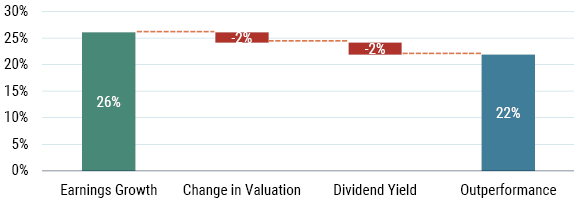

Our portfolio has outperformed the S&P 600 Index by a cumulative 22% since inception powered by superior earnings growth, as shown in the chart below. - Despite these strong returns, portfolio valuations remain attractive as there is ample opportunity to rebalance our concentrated portfolio of roughly 40 stocks.

SMALL CAP QUALITY RELATIVE TO S&P 600 RELATIVE RETURN DECOMPOSITION

Data from 9/21/2022 – 4/30/2024 | Source: Worldscope, S&P, GMO

The above information is based on a representative account in the strategy, selected because it has the fewest restrictions and best represents the implementation of the strategy.

Download highlight here.