Despite strong gains in equity markets last year and year-to-date as well as indexes sitting at all-time highs, we are extremely excited about the investing landscape from an asset allocation perspective. An abundance of cheap assets underpins this enthusiasm from an absolute return standpoint, while appealing valuation spreads within asset classes present us with the best relative asset allocation opportunity we’ve seen in 35 years.

We use a valuation-centric, dynamic asset allocation approach, consistently rotating toward the most attractive areas. By dialing into three current market dynamics, we are building portfolios with some of the highest forecasted relative and absolute returns we’ve ever seen.

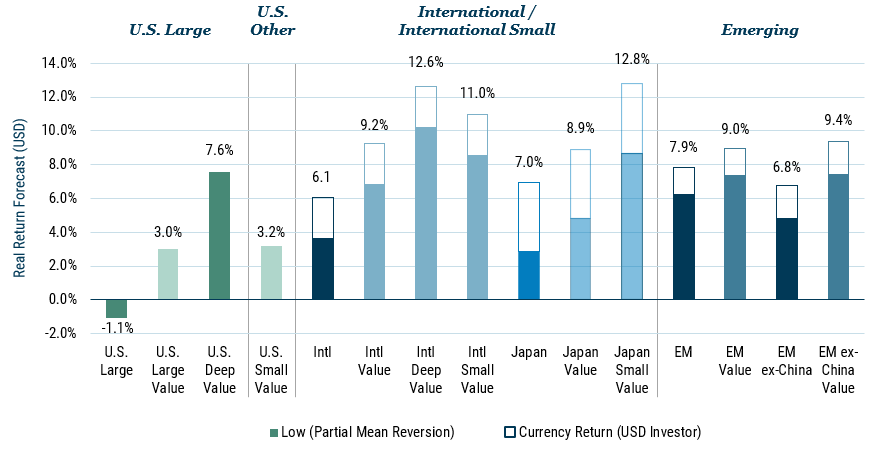

- Compelling forecasted returns across asset classes. We are currently able to find attractively priced assets across stocks, bonds, credit, and alternative strategies. For example, Exhibit 1 below shows that several equity groups have a high single-digit, or in some cases double-digit, expected return in excess of inflation under our most likely "low" interest rate scenario.

Exhibit 1: GMO Equity Forecasts* (USD)

February 29, 2024 – Low Scenario

Source: GMO

*The chart represents real return forecasts for several asset classes and not for any GMO fund or strategy. These forecasts are forward-looking statements based upon the reasonable beliefs of GMO and are not a guarantee of future performance. Forward-looking statements speak only as of the date they are made, and GMO assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results may differ materially from those anticipated in forward-looking statements.

- Extraordinary relative opportunities. The cheapest 20% of markets, which we refer to as deep value, are severely dislocated, trading at 3rd and 5th percentile discounts 1 compared to history in the U.S. and developed ex-US markets, respectively. We are heavily leaning into this compelling opportunity across our portfolios. 2

- Non-U.S. equities are cheap relative to the U.S. and cheap currencies add a tailwind. Not only do non-U.S. stocks benefit from attractive valuations, 3 but they also stand to profit handsomely from cheap currencies. Equity investors can capture the benefit of cheap currencies in two ways: either the currencies can appreciate back toward fair value, or the companies can exploit the competitive advantage of lower relative costs to boost earnings growth.

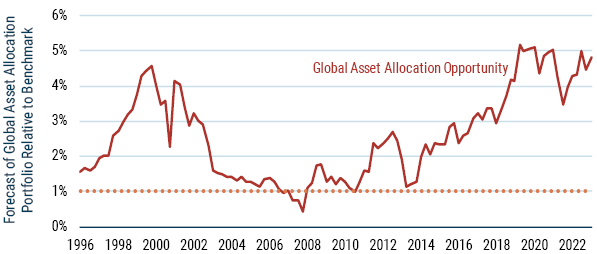

Exhibit 2 below indicates that, by taking advantage of the differential pricing across assets, we can build a portfolio – albeit a moderately unconventional one –that has the potential to beat a traditional balanced stock/bond portfolio by an incredible 5% per annum over the medium term.

Putting all of this together, we believe that there has never been a better time to shift portfolios – whether in whole or in part – to take advantage of these opportunities, and as our regular readers know, we don’t make such statements lightly.

Exhibit 2: Best Relative Asset Allocation Opportunity in 35 Years 4

As of 12/31/2023 | Source: GMO

Opportunity is difference between forecast return of portfolio and benchmark given GMO forecasts at the time. 10-year forecasts are translated to ‘7-year equivalent’ by multiplying by 10/7. Dotted lines are our long-term expectations of likely achievable alpha from asset allocation. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

Download article here.

As of 2/29/2024, using data going back to the early 1980s.

Our Equity Dislocation strategy seeks to benefit from this wide spread in styles by going long cheap value stocks and short expensive growth around the world. It remains the largest single position across most of our strategies. Further, GMO launched two long-only equity strategies, U.S. Opportunistic Value (June 2022) and International Opportunistic Value (May 2023), to capture the dislocation in deep value stocks in the U.S. and developed markets. We’ve allocated approximately 14% of multi-asset portfolios to these deep value strategies.

U.S. equities remain expensive trading at 33.8x on a cyclically adjusted price-to-earnings (CAPE) ratio basis, Japan about fairly valued at 24.6x, and Europe and emerging ex-China relatively cheap trading at 24.0x and 18.9x, respectively, as of 12/31/2023.

Exhibit 2 tracks the forecasted relative return of our longest-running asset allocation strategy, Global Asset Allocation, through time under our “Normal” forecast scenario.

Disclaimer: The views expressed are the views of the Asset Allocation team through the period ending March 2024, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Past performance is no guarantee of future results.

Copyright © 2024 by GMO LLC. All rights reserved.

As of 2/29/2024, using data going back to the early 1980s.

Our Equity Dislocation strategy seeks to benefit from this wide spread in styles by going long cheap value stocks and short expensive growth around the world. It remains the largest single position across most of our strategies. Further, GMO launched two long-only equity strategies, U.S. Opportunistic Value (June 2022) and International Opportunistic Value (May 2023), to capture the dislocation in deep value stocks in the U.S. and developed markets. We’ve allocated approximately 14% of multi-asset portfolios to these deep value strategies.

U.S. equities remain expensive trading at 33.8x on a cyclically adjusted price-to-earnings (CAPE) ratio basis, Japan about fairly valued at 24.6x, and Europe and emerging ex-China relatively cheap trading at 24.0x and 18.9x, respectively, as of 12/31/2023.

Exhibit 2 tracks the forecasted relative return of our longest-running asset allocation strategy, Global Asset Allocation, through time under our “Normal” forecast scenario.