Executive summary

At GMO we have spent the last four decades taking a long-horizon approach to equity investing. Over time, a unique and reliable group of standout companies emerged from our research. Through market cycles and dislocations, high-quality equities have proven to be a stable group of exceptional businesses ideally suited to compounding capital. While equity styles go in and out of favor, quality companies continue to serve clients as a core holding, resilient to economic headwinds and market drawdowns. For long-term investors searching for a durable equity solution, we believe quality is “the real McCoy.” 1

History of quality investing at GMO

GMO has managed a quality equity strategy since 2004, yet the history of quality research and investing at GMO can be traced back even further, to the earliest days of the firm. When Jeremy Grantham and his partners founded GMO in the late 1970s, Jeremy was grappling with the conundrum that high-quality business models are difficult for value investors to own because they tend to trade at premiums to the market. He recognized that a framework that enabled an investor to determine the relative quality of business models would give a truer sense of the intrinsic value of companies. Jeremy’s research led him to three key identifiers in a company’s financial history that are sound indicators of quality business models. Companies with a record of high profitability, stable profitability, and low leverage are most apt to be able to continue to grow at high rates of return throughout the business cycle and in various economic environments. By incorporating these quality factor terms in GMO’s early quantitative value models in the 1980s, GMO was able to own great businesses trading cheap relative to their quality-adjusted intrinsic value and also developed a better sense for when classic value companies were cheap for a reason and thus should be avoided.

As GMO built out its asset allocation capabilities in the 1990s, it became clear that the quality group of companies was a distinct third factor, or style, alongside value and growth and could be equally predictive of future return expectations. During the period marked by the expansion and bursting of the dot-com bubble, quality stocks moved independently of growth and value stocks. By the early 2000s, large cap growth stocks remained expensive, and value stocks had caught up. That left one group of companies with an attractive return forecast: quality.

In 2004, GMO launched the Quality Strategy with the mandate to own attractively valued stocks within the quality universe. The creation of the strategy was the culmination of decades of GMO research on quality business models. While the strategy’s origins date back to GMO’s earliest days, our process continues to evolve to ensure sustained relevance as well as our investment edge. We believe an increased emphasis on fundamental analysis in the last decade has given us a better chance to win and has further distinguished our approach from increasingly commoditized “factor” portfolios.

Investors in the strategy have always included a mix of tactical investors and those who consider the Quality Strategy to be a core, long-term allocation. It is worth mentioning that some of those earliest “tactical” investors still hold our strategy nearly 20 years later.

A third choice in the value vs. growth debate

The well chronicled teeth-gnashing over value vs. growth stems from the prolonged outperformance of growth over value dating back to the end of the Global Financial Crisis (GFC). Much has been written about the death of value, the nosebleed-level valuations of growth, and timing predictions for a long overdue rotation out of growth and into value. It is a dilemma at the forefront of many investors’ minds today, as it has been for much of the last several years. Indeed, the most recent couple of years of equity returns have been a classic whipsaw back and forth between value and growth.

In addition to general equity risk, the risks faced by value investors are different than those faced by growth investors. A growth investor risks overpaying for future growth that fails to meet lofty expectations. This can be especially true when growth is a scarce commodity or when specific industries become the subject of extreme hype. Value investors, on the other hand, risk buying those stocks whose cheapness is illusory: they are in fact value traps facing secular headwinds whose fundamentals deteriorate and never experience the multiple expansion that is an important driver of returns for value investors.

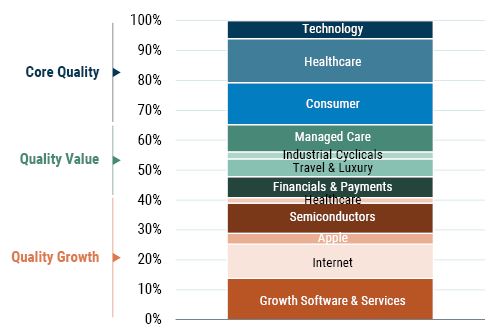

EXHIBIT 1: QUALITY INVESTING IS A THIRD WAY BEYOND GROWTH AND VALUE

Key exposures in the portfolio

As of 9/30/2023

The sectors are GMO groupings and not the S&P’s GICS sector classifications. For example, Alphabet is included in GMO’s Technology group, whereas the GICS classification places it in Communication Services.

By providing a third dimension on which to select stocks, a quality strategy can protect investors from the extremes of both styles by allowing them to own a portfolio that has delivered higher growth than the overall market.

The GMO Quality Strategy, with its preference for long-term, durable growth, helps to protect investors from the risk of overpaying for growth based on extrapolations of short, steep growth trajectories. Instead, our fundamental analysis seeks out companies with proven market leadership in markets with secular tailwinds that can strengthen market position through positive dynamics like network effects and high switching costs. These are the types of attributes that result in the long-term relevance of business models. Furthermore, our emphasis on fundamental strength identifies companies with clean balance sheets and low capital intensity that provide the financial durability and optionality optimal for long-term growth. Finally, an attention to valuations provides a margin of safety against the risk of overpaying for unrealistic or unsustainable growth expectations. Our valuation focus ensures that we are buying stocks with muted, not over-hyped, market expectations. The valuation focus is put into practice through our proprietary, conservative discounted cash flow model and by our preference for entering new positions when companies are trading under temporary clouds that impact short-term price but not long-term fundamentals.

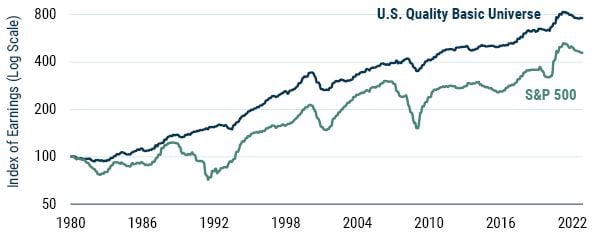

EXHIBIT 2: SLOW AND STEADY FUNDAMENTALS WIN THE RACE

Quality stocks have steadier earnings growth: 1980-2023

As of 10/31/2023 | Source: GMO

The U.S. Quality Basic Universe is the highest quality 1/4 of the U.S. market.

A well-managed quality strategy can offer protection from the risks faced by value investors. The GMO Quality Strategy seeks to own those companies with sustainable business models and strong fundamentals. The formation of our quality universe begins with a quant screen seeking companies with high, stable profitability and low leverage. An important component in building our quality universe is fundamental analysis oriented around identifying and understanding the high-returning assets underpinning the economic moat, assessing the long-term durability of a company’s business model, and ensuring that management has the will, the skill, and the means to continue to deploy capital at a high rate of return over a long horizon. We will not buy companies that do not meet our stringent quality criteria no matter how enticing their valuations may appear to be.

By providing a third choice to investors that navigates the treacherous shoals of growth and value while owning businesses that outgrow the market, we believe a valuation-aware quality portfolio like the GMO Quality Strategy represents a prudent way to gain core equity exposure.

QUALITY AND THE CONTENDERS

Quality’s stability, fundamental strength, and downside protection are an attractive blend of characteristics, and over the years we have observed contenders that investors use for similar reasons – low-volatility and smart beta factor portfolios/ETFs 2 being the two most popular. In this section of the paper we compare GMO Quality to quality factor portfolios and to low-volatility portfolios (both proxied by leading smart beta ETFs), highlighting the differences in the management and construction of the portfolios that can help explain the differences in return characteristics. Exhibit 3 lays out the performance comparison of the active GMO Quality Strategy vs. the passive contenders.

EXHIBIT 3: GMO QUALITY VS. SMART BETA ETFS

Data from 9/30/2015 through 9/30/2023 | Source: GMO

Note: The four ETFs were selected for comparison by GMO based on their size and significance. There are material differences between the ETFs selected and the GMO Quality Strategy that an investor should consider when assessing the comparison.

Let’s start with a comparison vs. low-volatility portfolios. A low-volatility strategy owns stocks that individually or in aggregate have generated low volatility over some trailing period with the aim of minimizing future volatility, thereby exploiting the alpha potential of the low-beta anomaly. A disadvantage of low-volatility portfolios is that they tend to exhibit significant time-varying style and sector exposures, often with abrupt turnover at inopportune times. Because stocks are selected purely for ex post low-volatility characteristics, this basket of stocks can and does vary significantly in style and sector exposure with little transparency. For example, many levered financial services companies seemed relatively low volatility in 2007 until suddenly they weren’t.

While the sector exposure profile of GMO's Quality Strategy evolves over time, its reliance on fundamental characteristics to form the universe and select stocks within the universe insures a high degree of stability and transparency. The same cannot be said of the low-volatility example. This can be problematic when low-volatility portfolios load up on stocks within expensive, crowded sectors. Because low-volatility portfolios tend to be valuation-unaware, exposure to expensive companies and sectors is a very real possibility.

Quality smart beta ETFs represent another option that has attracted inflows in recent years. The appeal of smart beta ETFs is that they can offer exposure to a factor using an automated approach. They typically provide this exposure by employing quantitative models to identify companies with quality characteristics through analysis of historical financials. As such, stock selection for these strategies begins and ends where our process begins. While we have a high degree of confidence in our own quant models, we recognize that the best quant models can produce false positives if, for example, a business model has exploited a niche that has eroded over time, or if perceived stability of profitability is merely a function of an unusually long cycle.

Similarly, sole reliance on quantitative screens can result in false negatives, and exclude long-term, durable quality business models that may not meet one criteria of the screen or may not yet have enough financial history for the model to sort.

It is these limitations of a purely “rearview mirror” quantitative approach that motivate GMO’s Focused Equity team to devote so much effort to the more adaptive, forward-looking fundamental aspect of our process. As a result, we weed out false positives at the company and industry level and include stocks in our portfolio that a purely quantitative approach cannot identify. Important eliminations of false positives have included AIG and home builder stocks prior to the GFC and, more recently, many retailers including Bed Bath & Beyond. Examples of the benefit of going outside the quant screen that we have invested in include American Express, which safely carries more leverage than the screen allows, and companies that have recently gone public or who carry some cyclical volatility that does not impair their long-term business prospects.

As is true with low-volatility portfolios, smart beta ETFs, to their detriment, suffer from valuation ignorance. When we compare holdings in our portfolio to smart beta ETFs, we find companies held in the ETFs that meet our quality criteria that we don’t own (or have sold) because the multiples on offer are no longer justified by our growth expectations.

Finally, smart beta ETFs tend to be unwilling to look too different from the benchmark. Many are constructed in a sector-neutral manner, which means they will hold the highest quality stocks in each sector with sector weights equivalent to the benchmark – irrespective of the quality of each sector.

The GMO Quality Strategy, on the other hand, is constructed to be benchmark-agnostic and owns no stocks in those sectors where we do not find quality business models, but instead may have significant concentrations in those sectors where quality companies proliferate such as Information Technology, Health Care, and Consumer Staples. Why would we want to own a Materials company or a Utility that doesn’t meet our quality criteria just because those sectors are included in the index? For factor portfolios, the focus on sector designation can lead to nonsensical outcomes. One of the prominent ETFs had zero weight in Alphabet until it was reclassified from Information Technology to Communication Services, at which point it became a large holding. Meanwhile, Alphabet’s business model had not changed one iota. In order to beat the index and deliver the highest quality portfolio, you have to look at the companies themselves, not their sector designations.

We believe the GMO Quality Strategy is an ideal core equity holding that has delivered strong returns, stability, and downside protection for investors for nearly 20 years and counting. By selecting stocks for their durable quality characteristics, it sits outside of the growth vs. value dilemma and avoids the pitfalls of those styles. Compared to similar approaches that employ more systematic commoditized processes but fail to consider valuation, the GMO Quality Strategy has delivered superior results and has earned the right to be called the real McCoy.

Download article here.

This paper was originally published on November 9, 2020.

When this paper was originally published in 2020, we had broadly labeled these “Quality ETFs.” It is worth specifying, however, that we were referring to factor-based or smart-beta quality ETFs that track an index (as opposed to active quality ETFs).

Disclaimer: The views expressed are the views of Kim Mayer through the period ending November 13, 2023, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2023 by GMO LLC. All rights reserved.

This paper was originally published on November 9, 2020.

When this paper was originally published in 2020, we had broadly labeled these “Quality ETFs.” It is worth specifying, however, that we were referring to factor-based or smart-beta quality ETFs that track an index (as opposed to active quality ETFs).