Overview

In this webcast, Head of Emerging Country Debt, Tina Vandersteel, and Senior Sovereign Analyst, Carl Ross, reflect and discuss as GMO celebrates 30 years of emerging market debt investing. Tina and Carl share invaluable insights, anecdotes, and lessons learned over the years and address today’s most compelling opportunities in the asset class.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

- GMO Emerging Debt has a differentiated approach to emerging debt. While most managers have both top-down and bottom-up elements in their investment process, GMO is differentiated from its peers in that such a large portion of its expected alpha comes from the bottom-up security selection rather than the top-down country selection - around 75% in of our hard currency Emerging Country Debt Strategy and 50% in our Emerging Country Local Debt Strategy.

- GMO Emerging Debt continues to evolve as client needs evolve. The GMO Emerging Debt team is committed to meeting the changing needs of our clients. Whether it is establishing separately managed accounts to factor in client-specific ESG or country restrictions, or launching new strategies that focus on areas such as distressed emerging debt, sovereigns with strong freedom and democracy characteristics, or structured finance projects that capitalize on countries transitioning off of fossil fuels, the GMO Emerging Debt team continues to adapt and evolve to meet client’s investment challenges.

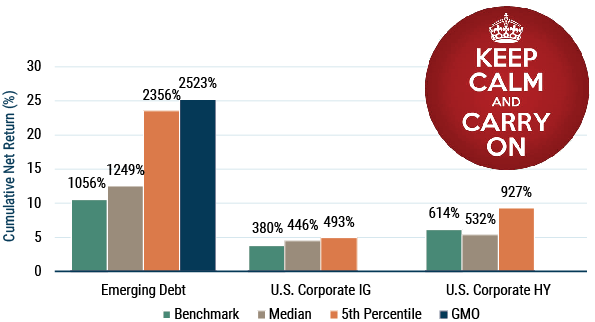

- The GMO Emerging Country Debt Strategy has consistently outperformed its benchmark over every time period since its inception 30 years ago. There never seems to be a dull moment in emerging markets investing. However, if you can “keep calm and carry on,” emerging debt has been an asset class that has rewarded investors with a higher return and higher alpha relative to U.S. investment grade and high yield over the past 30 years – with the GMO Emerging Debt Strategy outperforming all 5th percentile managers in its investment universe over this period. 1

The Power of Emerging Debt

Data from 4/30/1994 (inception of the GMO Emerging Country Debt Strategy) to 12/31/2023 | Source: eVestment

Benchmarks are the J.P. Morgan EMBIG Diversified (Emerging Debt), Bloomberg U.S. Corporate Investment Grade, and the ICE/BAML U.S. High Yield.

Download event highlight here.

Source: eVestment

Disclaimer: The views expressed are through the period ending April 24, 2024, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2024 by GMO LLC. All rights reserved.

Source: eVestment