Climate change awareness, attitudes, and opportunities have come a long way since GMO began writing on the topic in 2010. As part of Climate Week NYC 2020, GMO panelists discussed how oncoming spending on green infrastructure is creating opportunities for investors to participate in now.

We will green the global economy. We will take greenhouse gases down to zero, or even less. We will start to suck them out of the air – biologically or physically – but the damage to our still very agreeable planet will be great, perhaps enough to destabilize our political system.

- Jeremy Grantham

The Race of Our Lives: Update

Jeremy Grantham | Long-Term Investment Strategist and Co-Founder

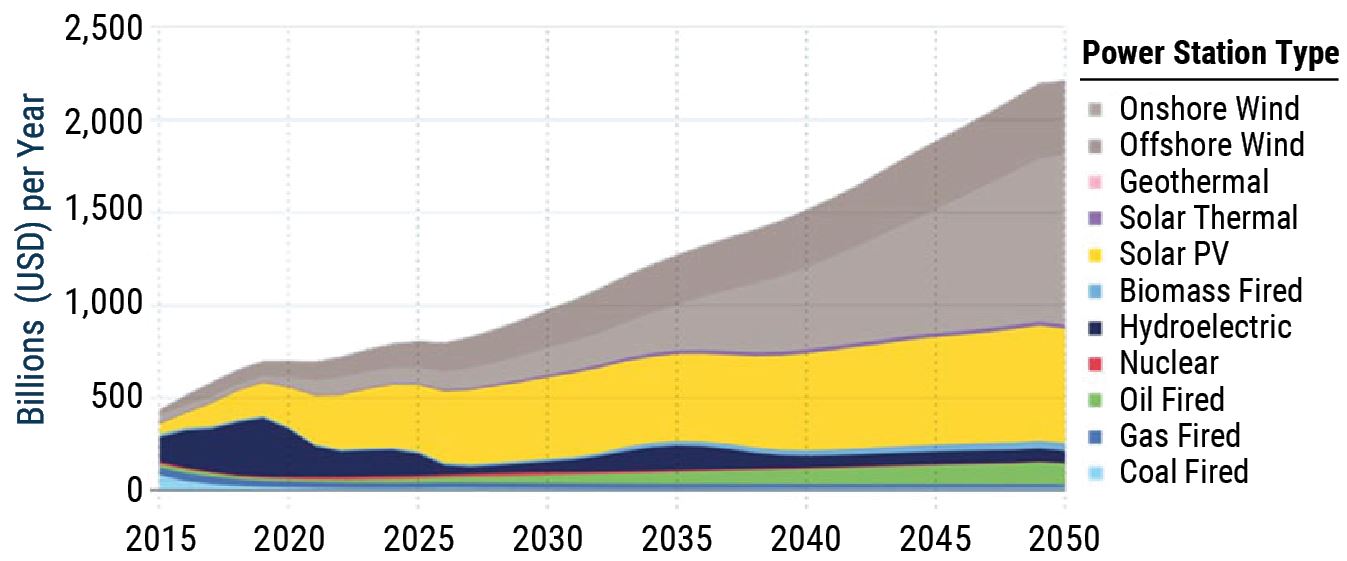

Trillions of dollars will be spent to green the economy. This will be the biggest shift since coal in the 19th century.

The transition will not be quick or easy. Humans are remarkably inventive, but vested interests, inertia and the love of good news will make it slow and difficult. Time is not on our side, it will indeed be The Race of our Lives and will be the most important challenge we face.

Significant progress is being made in green technology – particularly wind and electric batteries – and while it is not clear yet that we are winning, Grantham concludes: "We will green the global economy. We will take greenhouse gases down to zero, or even less. We will start to suck them out of the air – biologically or physically – but the damage to our still very agreeable planet will be great, perhaps enough to destabilize our political system."

We Need a Massive Amount of Investment to Head Off Climate Change

Source: DNV GL

Projections are subject to change and may vary significantly from the data shown.

GMO Climate Change Strategy

Lucas White | Portfolio Manager, Focused Equity

In the not so distant future, renewable energy will become the cheapest solution. The economics alone will drive a massive transition from fossil fuels to clean energy, regardless if the need was there (and of course, the need is there).

The world is not good at predicting transformational change or how quick the pace can be, and experts have dramatically underestimated the growth in clean technologies.

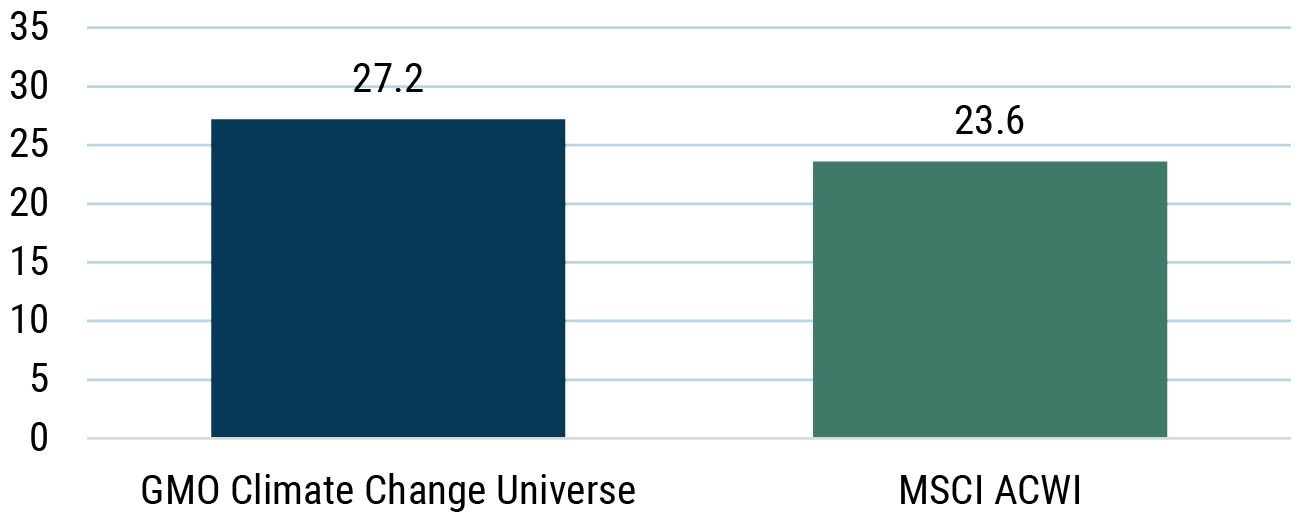

From an investment perspective, we are delighted with the valuations in the climate change sector. We are buying companies – at a substantial discount to the market – with secular growth tailwinds that are expected to persist decades into the future. It is an unexpected thing to get growth at a discount to the market, but you have to be very careful about the industries that you invest in.

Companies Positioned for Dramatic Secular Growth Are Trading in Line With the Broad Market

Price/Forward Earnings

As of 12/31/20 | Source: MSCI, IBES, GMO

IBES Price/Forward Earnings using 1 and 2 year analyst estimates.

Download the Event Highlights here.