Like you, we have read countless comparisons between today’s enthusiasm for all things AI and the top of the TMT bubble in 2000, with the implication being that stocks are on thin ice. In terms of technical description, the parallels are accurate – the narrowness of the market, the elevated cross-sectional volatility, and the concentration of capitalization in a few issues all look similar to the 2000 top.

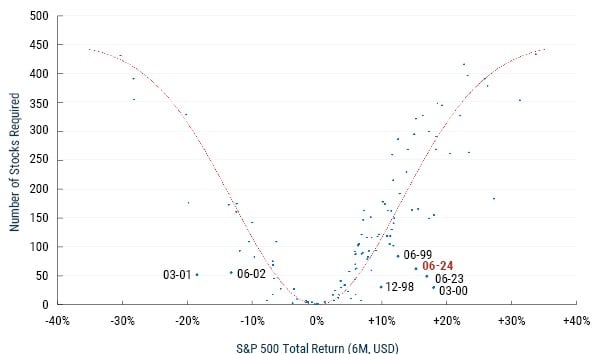

One way of looking at this is to count how many stocks it takes to explain the return of the S&P 500. Exhibit 1 shows how the number of stocks increases as the size of a six-month market move gets larger in both directions. It also shows that the narrow markets we have recently lived through are rather like those of early 2000 in magnitude and breadth: over the six months ending June 2024, just a few stocks accounted for all the S&P 500 return. Normally we might expect a return of this magnitude to be driven by hundreds of stocks.

Exhibit 1: How Many Stocks Explain the Whole S&P 500 Return since 1995?

Source: GMO | Data from 9/1995 through 6/2024

We are wary of arguments of the form, “the last time technical event X was observed, Y followed, and we see X today, so Y is just around the corner.” While these X-then-Y arguments can be useful prompts for vigilance – here, the investing equivalent of “don’t run with scissors” – they are too limited in scope.

Investment returns ultimately come from three sources: earnings growth, dividends received, and change in the earnings multiple. Our approach could be summarized as taking care of fundamentals by focusing on quality while controlling valuation risk by seeking to avoid overreach on the earnings multiple. If we compare today’s markets with the market top in 2000, we see less to fear today on both the fundamentals and the multiples. 1

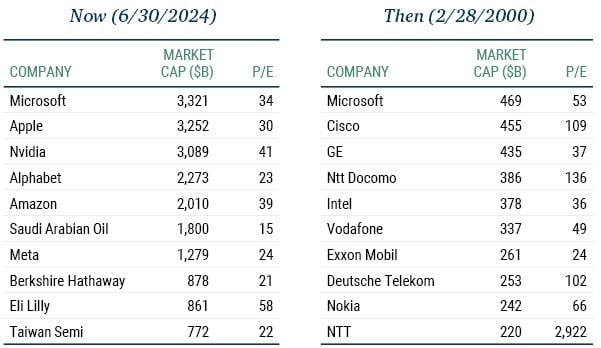

In 2000, the top-10 stocks comprised five telecom companies, two networking beneficiaries, a software business, an oil company, and a holding company. At the June 2024 quarter end, we have five cloud tech businesses, two chip companies, a pharmaceuticals company, an oil company, and a holding company (Exhibit 2).

Exhibit 2: Largest Companies Globally – Now and Then

Source: GMO

In 2000, the price-to-earnings ratio of the top 10 was 60x. Market participants were intoxicated by the ongoing communication revolution and heady fundamental returns of 22% per annum (p.a.) for the group over the preceding five years. The valuation was simply too rich. Even if the fundamental return expectation of 19% p.a. had been delivered and stock prices held, the top 10’s multiple would have still exceeded 25x by 2005. In reality the outcome was starkly different – the fundamental return was a relatively puny 8% p.a. for the group, with earnings falling at the telecom companies after what turned out to have been disastrous capital allocation in 3G spectrum auctions. Total returns were famously poor. Perhaps unsurprisingly, the stellar performer of the group – the only one to deliver a positive return – was the company the furthest from the TMT epicentre, Exxon.

2024’s top 10 have delivered similarly impressive fundamental returns of 19% p.a. since 2019, but the set-up is rather different to 2000, with a median P/E of 27x. If today’s top 10 were to deliver on 19% fundamental return expectations and prices were to stay the same this time around, the multiple would collapse to 12x by 2029. Implicitly, investors expect less from the mega-caps now than they did in 2000. In a real sense, the stakes are lower today.

A final “then and now” observation relates to the quality of the two top 10s. GMO’s longstanding systematic quality metric that we use for idea screening was in active service in 2000 (as were the writers of this piece). Based on an assessment of the level and stability of profitability, alongside balance sheet strength, 2000’s top 10 were barely better than the median business. By contrast, today’s top 10 sits squarely in the high-quality camp, with the midpoint just shy of the 10th percentile globally. That fits well with our fundamental assessment of quality – most of the current crop have stronger barriers to entry, interesting optionality (e.g., in AI and digitalization), and a better record in capital allocation, too.

None of this is intended to be determinative and we are not making another “X-then-Y” case. We are pointing out that in an important way the stars have aligned differently this time around, even if the market is superficially similar from a technical perspective. In the short term, it’s anyone’s guess. But looking further out, whether today’s mega-caps turn out to be great or less-than-great investments will be a result of the evolution of their fundamentals and the consequent impact on their valuation multiples. Unlike in 2000 when we held only a non-material weight in the top 10, we invest with confidence in a number of these companies today. 2

Download article here.

All numbers quoted here relate to medians for the top 10. Fundamental returns are calculated as dividend income and EPS growth in reporting currency. We proxy fundamental return expectations using dividend yield plus consensus earnings growth using IBES estimates. Price-to-earnings ratios are calculated using a constant 12-month window by blending a mix of FY1 and FY2 estimates.

Microsoft, Apple, Alphabet, and Meta are currently among our top holdings in GMO’s Quality and Quality Spectrum strategies.

Disclaimer: The views expressed are the views of the Focused Equity team through the period ending August 2024 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2024 by GMO LLC. All rights reserved.

All numbers quoted here relate to medians for the top 10. Fundamental returns are calculated as dividend income and EPS growth in reporting currency. We proxy fundamental return expectations using dividend yield plus consensus earnings growth using IBES estimates. Price-to-earnings ratios are calculated using a constant 12-month window by blending a mix of FY1 and FY2 estimates.

Microsoft, Apple, Alphabet, and Meta are currently among our top holdings in GMO’s Quality and Quality Spectrum strategies.