In our white paper, The Mystery of SOE Debt, published in September 2020, we demonstrated that State-owned Enterprise (SOE) defaults are rare. In this update, we clarify that our SOE investment process excludes SOEs of the variety currently defaulting in China, so we stand by our statement that SOE defaults are rare, conditional on using our detailed, well-researched definition of SOEs. As active investors who can find attractively priced true SOEs at healthy spreads over the sovereign, we believe the SOEs offer attractive alphas for our emerging debt portfolios.

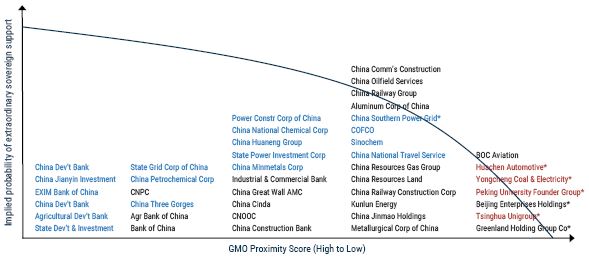

Recent defaults by Chinese SOEs have occupied the financial press, which is suggesting that such events may mark a regime change in the Chinese government’s handling of its SOE defaults.1 Below is an exhibit that shows our ranking of select Chinese SOEs according to a key pillar of our investment process, namely, how close we believe the SOE is to the sovereign in the event it needs a sovereign bailout. Companies on the left, like China Development Bank, are integral to the sovereign, like Fannie Mae has been to the U.S., say. On the other hand, we consider recently defaulted Chinese SOEs, like Huachen Automotive, to be hardly SOEs at all, notwithstanding how they’ve been rated – in particular by local rating agencies.2

GMO Quasi-Sovereign Process, Proximity of Chinese SOEs to the Sovereign

EMBIG issuers

*SOEs that are not majority owned by the central government, directly or indirectly via SASAC, Huijin or the MoF

Selected recent onshore and offshore defaulters

Bottom line: SOE definitions can vary, and, as with all credit investments, one should do one’s own research rather than rely on rating agencies or perceived – or even historical – sovereign support. Those of us who side-stepped the rampant mis-rating of “AAA-rated” structured securities in the GFC know this well. Having carefully reviewed the EM SOE investment universe, we are comfortable that our SOEs do not embed underpriced idiosyncratic default risk.

For those interested in other observations about our investment process (how we determine proximity to the sovereign, for example) or about nuances and details of these defaults in particular (foreign versus local rating agencies, 144a and other listing loopholes for disclosure, local versus foreign law protections, etc.) and other aspects of the detailed credit work that we do on each of our investments, please contact your GMO representative, and we’d be happy to speak with you.

Download article here.