GMO’s long history of valuation-sensitive investing

For nearly 50 years, GMO has been recognized as a disciplined valuation-focused investment firm applying our philosophy to both security and asset class selection. Our investment philosophy has always been rooted in the idea that an objective and disciplined assessment of valuations is critical: the price of an asset can deviate significantly from fair value over the short to medium term, but ultimately economic reality will prevail, and prices will move to reflect true intrinsic value.

GMO’s founders were fundamental investors who held the view that cheap does not necessarily mean value. Instead of simply looking for cigar-butt opportunities or buying the Fama-French low price/book factor, they picked stocks by building detailed, forward-looking discounted cash flow analyses for individual companies by hand. In the early 1980s, the emergence of computing power allowed them to apply their fundamental insights quantitively across more companies and asset classes. Throughout our history, we have always looked for balance sheets that provide a margin of safety and companies trading at attractive prices relative to their future earnings power (a function of growth and quality). Value investors should be willing to pay more for higher quality and faster growing companies. These tenets remain in place today and have been augmented in recent years to form what we view as a truly differentiated approach to value.

Value investing worked…until it didn’t

For the first couple of decades of GMO’s existence, and for half a century before that, value investing provided a strong and consistent premium, punctuated by inevitable periods of underperformance. From the late 1920s through mid-2006, the value factor as defined by Fama-French (HML) outperformed growth by 4.9% per year, a run that included the horrific value drawdown of the late 1990s as the Internet bubble peaked. The sources of this long-standing premium are debated, but generally focus on behavioral underpinnings with investors overpaying for lottery tickets (growth) and extrapolating recent problems (value). Since July 2006, however, value has underperformed for a longer period of time and by a greater magnitude than it did even during the Internet bubble.

This sustained and deep period of underperformance has led many investors to question whether the value premium is dead. We extensively analyzed the question and do not believe that value is broken. 1 Our analysis suggests that value’s extended run of relative underperformance was not due to the group exhibiting any weaker-than-normal fundamental growth. Instead, value’s underperformance all came down to valuation. Value started the period somewhat rich vs. its history and ended up trading at or near a record discount, while growth valuations exploded and remain expensive today.

Times have changed and so have the rules

Value is not broken, but the nature of value investing has changed. Information is more comprehensive and widely available than in the past. Business models have changed where many companies rely more on intangible assets to generate sales and earnings instead of traditional capital such as property, plant and equipment. As a result, traditional accounting-based metrics used by index and passive fund providers to define “value” groups are increasingly detached from economic reality for a large part of the market, and thus do not provide a realistic view of a company’s productive assets or future earnings power.

Passive value approaches in general present several problems today, as they:

- Rely on reported book value, which is meaningless in many cases. Reported book value understates true economic or productive capital given it ignores intangible assets and the impact of net issuance.

- Use primarily backward-looking valuation metrics. Indexes largely rely on simple valuation ratios, which are shorthand methods that lack careful consideration of future revenue growth paths, margin structures, and payout assumptions.

- Embed large sector biases. Heavy reliance on reported book value metrics leads to big sector imbalances thus leaving value overweight sectors like Utilities, which have large book values due to significant tangible assets, and underweight asset-light sectors such as Communication Services.

- Do not screen out value traps. By definition, index value incorporates the cheapest companies, many of which deserve to be cheap given meager growth prospects or low quality (high leverage or low profitability).

Building a better value mousetrap – GMO Value vs. the factor

GMO capitalizes on value dislocations and improves on simple value through both top-down and bottom-up efforts. Top-down, we seek groups of stocks that are collectively mispriced relative to long-term fair value. Bottom-up, we look for individual securities that are mispriced relative to our assessment of true fundamental value.

Top-down: Finding and “intelligently” accessing value

GMO’s research aims to understand how and why you get paid to own an asset and determine what an asset is worth based on assessments of those underlying drivers. We blend quantitative modeling with fundamental research to identify opportunities in broad indexes or custom groups of stocks and then test the validity and sensitivity of our key assumptions. In rare circumstances where we find an extraordinary valuation opportunity (e.g., a bubble or true dislocation), GMO investment teams both design and implement a strategy specifically to target that insight. The willingness to pinpoint opportunistic investments and the expertise that allows us to do so in an efficient and timely manner are key features of GMO’s approach to finding value.

Bottom-up: Identifying mispriced securities relative to long-term fair value

From a securities selection perspective, we use three key features in our approach that distinguish GMO Value from traditional index value:

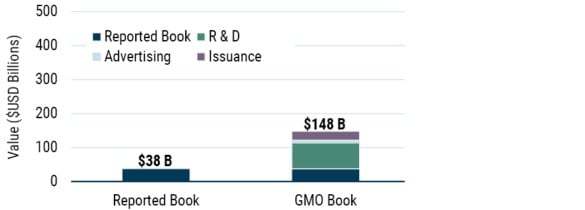

- Build a better starting point. Through a multi-year research project, we developed proprietary versions of each company’s current and historical balance sheets (and income statements) to arrive at an estimate of productive capital – which we call GMO Book – that both represents economic reality and allows for reasonable comparisons between companies. Calculating GMO Book involves capitalizing various types of expenditures that we believe represent genuine investments (e.g., research and development expense) and making share issuance adjustments. The result is an estimate of shareholders’ equity that is superior to that supplied by financial statements alone. This adjusted shareholders’ equity forms the basis of our valuation work.

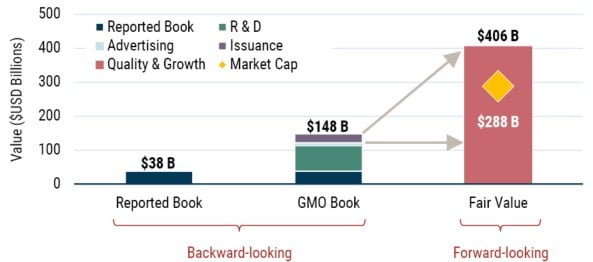

To see GMO Book in action, Exhibit 1 below provides a visual example reflecting the difference between Merck’s reported book value of $38 billion and our more realistic assessment of $148 billion. This, of course, gets us partially to Merck’s true fair value, but not all the way there given the approach doesn’t fully account for the worth of other intangibles or future fundamental growth. To capture Merck’s full intrinsic value, we must also incorporate the company’s quality and growth outlook.

EXHIBIT 1: GMO BOOK PROVIDES A MORE REALISTIC VALUE OF SHAREHOLDER VALUE

Merck & Co. Inc. – Reported vs. GMO Book Value

As of 8/31/2024 | Source: GMO - Design forward-looking models that do a better job projecting fundamentals. A more accurate measurement of economic fundamentals is a good starting point, but a true picture of a company also includes how the business is likely to grow looking forward. Our proprietary Price to Fair Value (PFV) model builds upon the original quantitative model Jeremy Grantham developed in the early 1980s using book value and return on equity to systematically analyze thousands of companies. The model recognizes that profitability and reinvestment are the drivers of future growth and that higher quality companies tend to retain higher levels of profitability for longer. GMO’s PFV valuation model is a 20-year dividend discount model that starts with our proprietary GMO Book and adjusted ROE data, and projects future ROE using a lasso regression.

By calculating and discounting the future dividends a company will generate over the next 20 years, PFV considers growth and the quality characteristics that traditional multiples-based valuation approaches ignore. As Exhibit 2 suggests, changing the valuation methodology from backward- to forward-looking switches Merck’s valuation from appearing expensive to attractive.

EXHIBIT 2: PRICE TO FAIR VALUE (PFV) INCORPORATES GROWTH AND QUALITYMerck & Co. Inc. – PFV is a Forward-looking Valuation Model

As of 8/31/2024 | Source: GMO - Incorporate signals beyond valuation. We use alternative indicators of mispricings to gain a differentiated view into company fundamentals, including sentiment and corporate governance signals. We built a proprietary tool using a suite of empirical signals to identify suspicious corporate profiles. These “alerts” have proven effective in reducing instances of value traps. Further, alerts improve our expected outcomes without directly pushing against the value characteristics we seek. Contrast this with incorporating a signal like positive momentum, which favors stocks that have risen in price and valuation.

Conclusion

Value investing worked for decades by capitalizing on inefficiencies stemming from behavioral biases. After an extended stretch of underperformance, however, there are those who question value’s ability to outperform going forward. While such skepticism is to be expected, we don’t think it is warranted. The underperformance of value stocks can be explained primarily by their falling relative valuations, not weaker-than-normal fundamental growth. 2

In our view, value today is priced to win, and history tells us that winning investment strategies are usually those that ex-ante are driven by the most difficult decisions. It’s easy to buy trailing performance and expect that streak to persist, but dislocated valuations ultimately revert, 3 leaving the assets that investors have given up on positioned to outperform. Even if the wide gap between value and growth fails to narrow, we believe value will outperform thanks to the continual reconstitution of value and growth groups with cheap stocks entering the value universe while the more expensive ones graduate to growth. This rebalancing phenomenon makes value a lower risk position than many might believe today. If, however, the value discount reverts to anywhere near its long-term average, value’s outperformance would be sizeable.

Investors should carefully consider how they gain exposure to the current opportunity. While index products offer an easy and widely accepted way to access value, at GMO, our suite of robust valuation models goes beyond seeking low-multiple stocks. GMO Value thoughtfully assesses and projects companies’ profitability and identifies groups and individual securities that are priced attractively relative to fair value. The result is a suite of differentiated and superior value strategies available through a variety of vehicles, now including ETFs.

APPENDIX

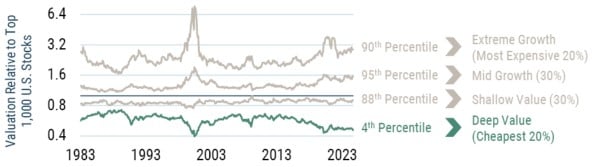

Deep value is truly dislocated – capitalizing on the opportunity

Today, we find an extraordinary opportunity in deep value stocks (the cheapest 20% of the market). In both the U.S. and international equity universes, these cohorts of stocks are trading at valuations in the bottom decile of their history relative to the overall market.

EXHIBIT 3: DEEP VALUE IS EXTREMELY CHEAP GLOBALLY

Valuation groups in top 1,000 U.S. Stocks

Valuation groups in MSCI World ex-U.S. Universe

As of 9/30/2024 | Source: GMO

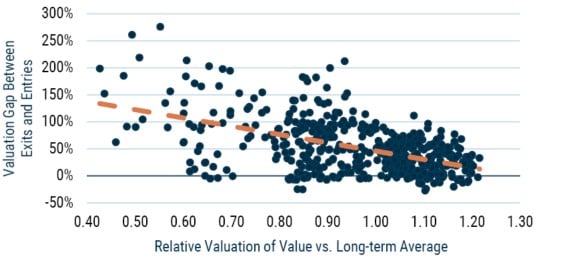

In a reversion scenario where all cohorts return to median relative valuations, deep value is priced to outperform dramatically. However deep value does not require a valuation reversion to beat the market. Even if the cohort remains cheap, deep value investors are positioned to win through the natural turnover of the universe, which is particularly accretive to value investors when valuation spreads are extraordinarily wide. The magnitude of the benefit for value and pain for growth is driven by the gap between the valuations of the exits and entries from the value or growth universe. Exhibit 4 shows a scatterplot of the size of this gap against the ratio of the valuation of value to growth stocks. As the dashed regression line shows, there is a pronounced tendency for this exit/entry valuation gap to be larger when the valuation spread between value and growth is larger. 4

EXHIBIT 4: VALUATION SPREAD DRIVES RETURN FROM REBALANCING

Data from 1982–2022 | Source: GMO, Compustat, Worldscope, MSCI

MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

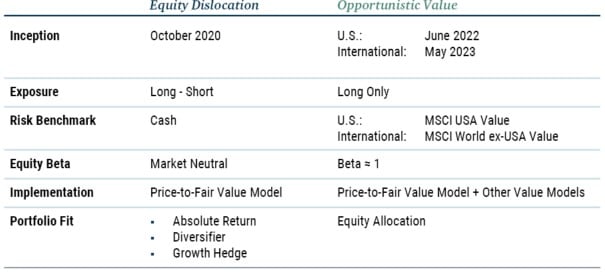

Because deep value is such a high conviction active insight, we have built three strategies to capitalize on the opportunity:

- U.S. Opportunistic Value focuses on capturing the deep value opportunity in the U.S. by sorting stocks on proprietary GMO Value and investing in the cheapest 20% cohort on our metrics.

- International Opportunistic Value focuses on capturing the deep value opportunity in the developed ex-U.S. markets by sorting stocks on proprietary GMO Value and investing in the cheapest 20% cohort on our metrics.

- Equity Dislocation is a market-neutral, absolute return strategy designed to capitalize on the value dislocation. This strategy is 100% long the cheapest stocks and 100% short the most expensive extreme growth stocks as determined by GMO Value.

EXHIBIT 5: CAPITALIZING ON THE VALUE DISLOCATIONS

Two Unique Approaches: Equity Dislocation and Opportunistic Value

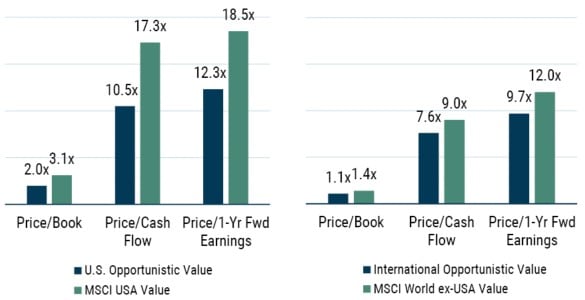

By focusing on the cheapest part of equity markets, incorporating growth and quality into our valuation process, and including thoughtful construction parameters (such as not having to own any stock we deem expensive), we can construct long-only deep value portfolios today that trade not just cheaply relative to the market, but also at discounts to broad value. Importantly, following this approach enables us to build portfolios of similar quality to value benchmarks, despite our valuation advantage. 5

EXHIBIT 6: GMO U.S. AND INTERNATIONAL OPPORTUNISTIC VALUE STRATEGIES

Portfolio characteristics vs. value benchmarks

As of 9/30/2024 | Source: GMO

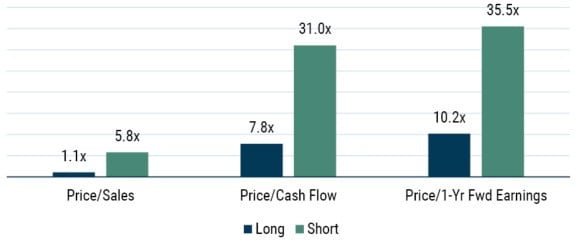

Similarly, in Equity Dislocation, we can build a long-short portfolio with abnormally wide valuation gaps between long and short exposures, as shown in Exhibit 7.

EXHIBIT 7: GMO EQUITY DISLOCATION STRATEGY

Long/short portfolio characteristics

As of 9/30/2024 | Source: GMO

Since we launched Equity Dislocation Strategy in the midst of a growth bubble in late 2020, an index approach to capitalize on the dislocation by going long MSCI ACWI Value while shorting MSCI ACWI Growth rose a modest 3.4% through September 2024, suggesting much of the opportunity remains intact. In contrast, the strategy generated a cumulative gross return of 51.0% (37.9% net) over the same period. This strong outperformance stems from the strategy’s risk-aware structure, unwavering focus on the very cheapest and most expensive stocks, and strong stock selection, presenting a useful case study of GMO Value in action.

Download article here.

See GMO’s 3Q20 and 2Q21 Quarterly Letters, Value: If Not Now, When? (Ben Inker and John Pease) and Dispelling Myths in the Value vs. Growth Debate (Ben Inker), respectively.

In regard to what happens next, Ben Inker wrote the following in 2Q2021’s Dispelling Myths in the Value vs. Growth Debate: “A belief in a continued ‘secular trend’ in favor of growth stocks therefore requires two beliefs. First, that the massive upward relative revaluation of growth stocks that we have seen in recent years understates the revaluation that they actually deserved, and second that this underreaction is due to a future outlook for these companies that is far better than anything they have achieved historically, including in the period of their recent outperformance.” On the other hand, for value to win, “we merely need to believe that the future prospects of value stocks are not drastically worse than they have been in either the long term or the relatively recent past.” This in fact has been the case.

While many argue active management is dead and markets are efficient, the rise and fall of numerous bubbles and mini-bubbles (crypto in 2017, cannabis in 2018, EV, SAAS, and ARKK in 2020, etc.) suggest equity markets, especially at the asset class level, remain inefficient and prone to fear and greed cycles.

See Ben Inker’s 3Q 2022 GMO Quarterly Letter Parts 1 and 2, The Value Opportunity Updated and Time to Dive Deep into Value.

As of 9/30/2024, GMO’s U.S. Opportunistic Value Strategy had a debt/equity ratio of 0.7x vs. 0.9x and return on equity of 16.4% vs. 15.4% for the MSCI USA Value Index, respectively. GMO’s International Opportunistic Value Strategy had a debt/equity ratio of 0.7x vs. 1.0x and return on equity of 13.4% vs. 12.3% for the MSCI World ex-USA Value Index, respectively.

Disclaimer: The views expressed are the views of Rick Friedman, Catherine LeGraw, and John Thorndike through the period ending November 2024 and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Past performance is no guarantee of future results.

Copyright © 2024 by GMO LLC. All rights reserved.

See GMO’s 3Q20 and 2Q21 Quarterly Letters, Value: If Not Now, When? (Ben Inker and John Pease) and Dispelling Myths in the Value vs. Growth Debate (Ben Inker), respectively.

In regard to what happens next, Ben Inker wrote the following in 2Q2021’s Dispelling Myths in the Value vs. Growth Debate: “A belief in a continued ‘secular trend’ in favor of growth stocks therefore requires two beliefs. First, that the massive upward relative revaluation of growth stocks that we have seen in recent years understates the revaluation that they actually deserved, and second that this underreaction is due to a future outlook for these companies that is far better than anything they have achieved historically, including in the period of their recent outperformance.” On the other hand, for value to win, “we merely need to believe that the future prospects of value stocks are not drastically worse than they have been in either the long term or the relatively recent past.” This in fact has been the case.

While many argue active management is dead and markets are efficient, the rise and fall of numerous bubbles and mini-bubbles (crypto in 2017, cannabis in 2018, EV, SAAS, and ARKK in 2020, etc.) suggest equity markets, especially at the asset class level, remain inefficient and prone to fear and greed cycles.

See Ben Inker’s 3Q 2022 GMO Quarterly Letter Parts 1 and 2, The Value Opportunity Updated and Time to Dive Deep into Value.

As of 9/30/2024, GMO’s U.S. Opportunistic Value Strategy had a debt/equity ratio of 0.7x vs. 0.9x and return on equity of 16.4% vs. 15.4% for the MSCI USA Value Index, respectively. GMO’s International Opportunistic Value Strategy had a debt/equity ratio of 0.7x vs. 1.0x and return on equity of 13.4% vs. 12.3% for the MSCI World ex-USA Value Index, respectively.