In the world of sovereign debt, both lenders and borrowers have long understood that default has costs. For the lender, those costs usually come in the form of write-downs on the principal amount they are owed, or on the coupons they are scheduled to be paid. For borrowers, however, these costs are less immediate and straightforward, with a failure to pay today meaning a loss of market confidence and higher borrowing costs tomorrow.

Two countries suffering such an effect are Argentina and Ecuador, each of which has endured multiple defaults, most recently in 2020. For various reasons, both have since struggled to recoup the necessary confidence to once again borrow in international commercial debt markets. For these countries, the question goes beyond the usual: Should these countries pay an additional premium as a recently defaulted country? Rather, for these two borrowers, investors have asked the question: Can these countries ever return to the markets, given their multiple episodes of default? Are they simply incorrigible?

Unfortunately, the question of sovereign incorrigibility, for lack of a better term, is a reasonable one to contemplate in both cases, especially for investors who have followed these credits over the years. Such investors no doubt recall the excitement for Argentina following the pro-market Mauricio Macri’s ascent to the presidency in late 2015, or, more recently, for Ecuador upon the reformist Guillermo Lasso’s surprise electoral victory in 2021. Both events seemed to portend the end of dominant, economically destructive, and market unfriendly ideologies of Kirchnerism and Correism, respectively. Both, however, ended in disappointment: Macri’s administration failed to generate consistent market confidence, ending in economic crisis and the political collapse in 2019, while Lasso’s foundered in the face of a divided congress and political turbulence, ending in his impeachment earlier this year.

To understand the extent of investors’ lack of faith in the two countries, we need look no further than bond prices: at the end of September, the average price of bonds in the EMBI Global index were roughly $28 for Argentina and $39 for Ecuador. What is especially striking is that bond prices have remained depressed even amid the possibility of positive political breakthroughs. That is particularly the case for Argentina, where preliminary signals ahead of next month’s elections point to a vehement rejection of Kirchnerism and an embrace of economic reform. Ecuador, meanwhile, faces a run-off election for which polls are pointing to yet another political defeat of Correism.

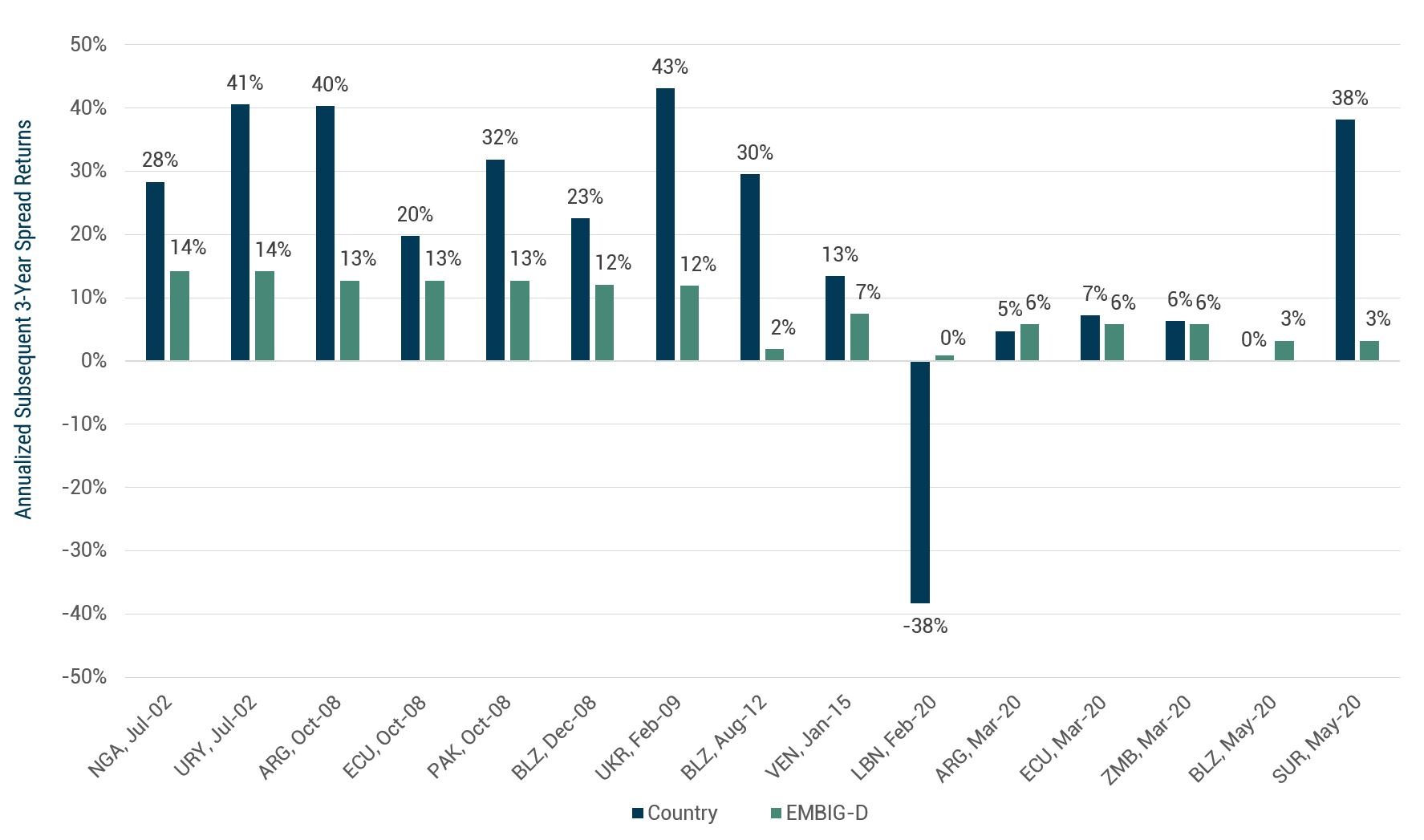

For context, the exhibit below looks at each instance this century where a country saw its average index bond prices fall below $40 and remained in the index for at least three years. In most cases, country spread returns in the subsequent three-year period significantly outpaced those of the index. This trend is more muted since 2020, probably owing to more challenging macro conditions for distressed and high-yield credits. Yet, even in the case of Argentina and Ecuador, which have faced enormous political and economic challenges since their 2020 defaults, country spread returns have roughly kept pace with those of the index.

ANNUALIZED 3-YR RETURNS AFTER AVERAGE INDEX BOND PRICES FELL BELOW $40

Since 2000, the majority of countries have seen returns well above those of the index

As of 8/31/23 | Source: JPM

This approach is, admittedly, oversimplified. For one, the recent rise in U.S. rates means that, holding spreads over Treasuries constant, emerging sovereign bond prices will tend to be lower for reasons unrelated to sovereign risk. Second, Argentina and Ecuador’s current bonds were issued at steep discounts, thanks to the low coupons coming out of their 2020 restructurings. Yet, these factors fail to fully account for the two countries’ exceptionally low bond prices. To illustrate, we imagine the price impact if Argentina and Ecuador were to converge to 1,000 bps in spreads over Treasuries, roughly the level of non-distressed B and CCC peers in the index that are still outside what we would consider “market access.” 1 Returns even in this relatively conservative case would be massive: using prices at the time of writing, Argentina’s 2035 dollar bond price would rise from $24 to $49, and Ecuador’s 2035 dollar bond from $37 to $58. Markets, in other words, are ascribing extremely low probabilities that these two countries will even get close to levels that would allow them to access eurobond markets once again. Despite these countries’ checkered pasts, we find this remarkable given their light eurobond payment schedules in the near term and certain economic tailwinds, particularly for the external sector (for Argentina, mainly around production in the agriculture, energy, and mining sectors; for Ecuador, with oil prices well above budget). How, then, does GMO approach credits with such complex default histories? One of the characteristics of our strategy over its nearly 30-year history has been its disciplined focus on aspects of credit risk that we can know and measure, while remaining agnostic about those we cannot. In the former category are things like debt levels, interest burdens, and stocks of international reserves. In the latter are things like elections,legislative agendas, and broad cultural shifts (like the ones currently being debated in Argentina and Ecuador).

Based largely on the first category of information, we are overweight both credits in our external debt strategy. In our view, markets are pricing in overly pessimistic outlooks based on fundamentals. Undoubtedly, the risk of disaster is greater than zero. For Argentina, this might include the failure of a new administration’s reform agenda, while in Ecuador, it might entail political gridlock and social upheaval against a newly elected government. To complicate matters further, market pessimism could make for a self-fulfilling prophecy, whereby the countries’ funding options are constrained to the point that further restructurings are inescapable. In other words, there is scope for bond prices to fall from already distressed levels.

Disciplined and dispassionate thinking, however, also requires us to be open-minded about what can go right, not just what can go wrong. That is especially the case for Argentina, which appears to find itself at yet another political crossroads. Put another way, we should defend not just against the excessive optimism of “this time is different” that has tempted investors in the past, but also the pessimistic fatalism of “it will never happen.” Even as we recognize the costs of countries’ records of default, history is not, ad infinitum, destined to repeat itself. In other words, no country is truly incorrigible.

Download article here.