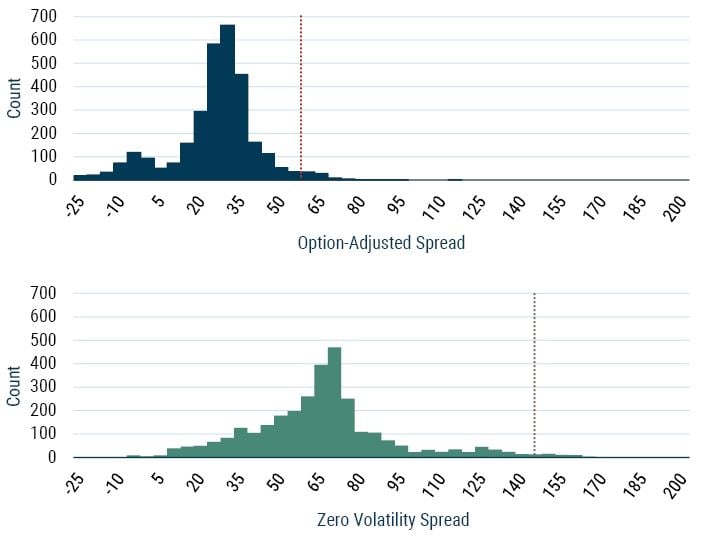

As of April 25, the Bloomberg U.S. Mortgage-Backed Security (MBS) Index was trading at an option-adjusted spread of 65 bps, which ranked in the 91st percentile since 2010. We believe moves in the asset class have been overdone and that current valuations present an opportunity. GMO’s proprietary model for agency MBS, which is driven by spreads, option costs, realized volatility, and carry, specifically finds current coupons attractive.

CURRENT COUPON MBS SPREADS

12/31/2010 through 4/25/2023

As of 4/25/2023 | Source: GMO, J.P. Morgan DataQuery

- The mortgage market has struggled to perform in 2023. Elevated interest rate volatility and concerns of indiscriminate selling of distressed regional bank balance sheet holdings have pushed spreads wider. The sector has underperformed Treasuries by 1.2% over the past 12 months through April 25, making MBS the second worst performer within the U.S. Aggregate over that period.

- Investors simply looking to add a long MBS position based on the cheapness of option-adjusted spreads could take a position in lower coupon bonds. Underlying mortgages of these bonds are concentrated in the 2.50% to 3.50% range and have more certain cash flow streams today given the limited impact of the borrower’s embedded prepayment option (i.e., minimal negative convexity).

- However, with interest rate volatility still elevated, we prefer to own current coupons. Buying current coupon MBS is a way to gain exposure to the cheapness of the mortgage market while expressing a view that high levels of volatility will mean revert. Current coupons, both on option-adjusted and zero-volatility spread measures, look appealing, as shown in the charts above. 1

- Another reason we prefer current coupons is that bank portfolios are heavily skewed toward lower coupons. We believe these may struggle to outperform during the balance sheet unwind currently being conducted by BlackRock Financial Markets Advisory.

- For investors looking to take a relative value approach in U.S. credit, current coupon MBS are priced advantageously versus investment-grade corporates, in our opinion. The relatively tight spreads from corporate bonds do not offer any additional compensation in this high-volatility environment, making MBS a strong choice in comparison. 2

- Investing in agency mortgages in this environment does not come without risks, of course. Further upticks to implied rate volatility could challenge our thesis. In addition, the balance sheet unwinds and loss of future buying sponsorship from banks and the Fed could challenge MBS markets further, though we believe much of this has already been priced in by the market.

With attractive valuations, and for the reasons listed here, we have recently increased our exposure to current coupon agency MBS within both the GMO Opportunistic Income and Multi-Sector Fixed Income Strategies.

Download article here.

As a refresher, mortgage bond option-adjusted spreads measure the excess yield achieved by buying MBS and hedging the borrower’s prepayment feature with interest rate options. Alternatively, zero-volatility spreads add to option-adjusted spreads the implicit premium earned from “selling” the prepayment option to the borrower.

For another compelling alternative to corporate credit, see AAA CMBS: Loss-remote, liquid, and cheaper than IG (Nabet and Ramachandran, 2023).

Disclaimer: The views expressed are the views of James Donaldson and Jason Lowry through the period ending May 1, 2023, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2023 by GMO LLC. All rights reserved.

As a refresher, mortgage bond option-adjusted spreads measure the excess yield achieved by buying MBS and hedging the borrower’s prepayment feature with interest rate options. Alternatively, zero-volatility spreads add to option-adjusted spreads the implicit premium earned from “selling” the prepayment option to the borrower.

For another compelling alternative to corporate credit, see AAA CMBS: Loss-remote, liquid, and cheaper than IG (Nabet and Ramachandran, 2023).