Overview

In this webcast, GMO’s co-heads of Asset Allocation, Ben Inker and John Thorndike, share their ideas for most effectively deploying capital in 2024. They then discuss market risks and opportunities and answer questions about the investment landscape ahead.

Contact Us to Watch the Replay*

*This content is intended for accredited investors only.

Key Points

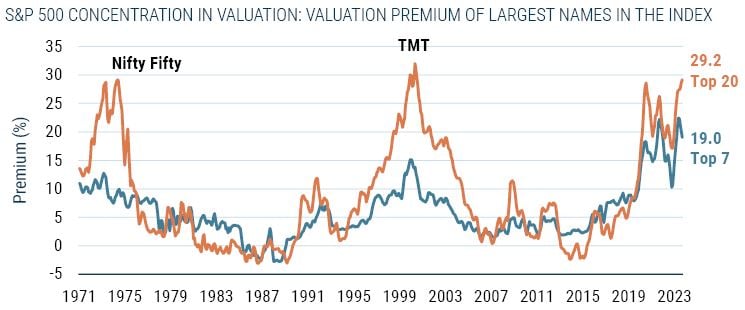

- The S&P 500 is at peak concentration in both market cap and valuation terms. Your U.S. equity portfolio can work harder for you if you are willing to move away from passive S&P 500.

- GMO’s Quality Strategy is an actively managed large cap portfolio with an unrelenting focus on quality and valuation.

- Peak concentration of the large cap index also makes this an optimal time to consider small cap, such as GMO’s Small Cap Quality portfolio, or value, like our U.S. Opportunistic Value portfolio, which is concentrated in deep value stocks.

Idea #1: go active in u.s. equities

S&P 500: extreme concentration in market cap and valuation

Preliminary as of 12/31/2023

S&P does not guarantee the accuracy, adequacy, completeness or availability of any data or information and is not responsible for any errors or omissions from the use of such data or information. Reproduction of the data or information in any form is prohibited except with the prior written permission of S&P or its third-party licensors. Please visit https://www.gmo.com/americas/benchmark-disclaimers/ to review the complete benchmark disclaimer notice.

- Structured credit offers an outstanding reward for inherent risks today. GMO’s Opportunistic Income portfolio yields over 7% 1 and bears little interest rate or credit spread duration with limited risk of principal loss.

- If you are concerned that the market’s economic expectations are too optimistic, Quality can deliver efficient recession protection. Our GMO Quality Spectrum portfolio supercharges this benefit by going 170% long the highest quality stocks, and 70% short the junkiest. That junk short can really pay off in tough economic environments.

- Deep value is truly dislocated, and is currently the biggest active position across GMO’s asset allocation portfolios. We are capturing this opportunity long-short via our Equity Dislocation portfolio, which is 100% long the cheapest Value stocks and 100% short the most expensive Growth stocks. Additionally, we hold long positions in the U.S. and International Opportunistic Value portfolios – both recently launched to capture this deep value opportunity.

Q&A Highlights

Below are select participant questions answered live during the webcast. Please refer to the event replay for full Q&A.

- Is there a contradiction between loving Quality right now and loving Deep Value?

If you were building a deeply junky, deeply cheap portfolio, there would absolutely be conflict. However, as we construct a deep value portfolio (GMO U.S. Opportunistic Value Strategy, GMO International Opportunistic Value Strategy), we care a lot about quality. Not only do quality characteristics (high profitability, stable profitability, low leverage) help protect you in a recession but higher quality companies tend to be profitable for longer than people think and that gives them more value in a dividend discount model.

Historically, it might have been the case that in order to get a really cheap portfolio, you had to own a really junky portfolio. That was kind of the case right at the bottom of the of the global financial crisis; a lot of very junky companies were trading very cheap. That is not the case today: You do not have to own junk in order to own really cheap companies.

Conversely, GMO’s Quality Strategy does not have to compromise on quality to own a decently valued company.

- You made a good case for structured credit. What’s your view on other segments of credit markets?

Emerging debt (GMO Emerging Country Debt Strategy) is our second favorite credit market. We see spreads as pretty reasonably valued, and the opportunity for security selection there is attractive. In corporate credit, spreads are tight relative to fair value; we would rather put together portfolios of cheap assets than fair assets, so we have been mostly avoiding corporate credit or reducing our exposure there in order to own more structured credit (GMO Opportunistic Income Strategy) or even to own equities.

- Please comment on the valuation of U.S. versus international markets. What’s your view on Japan?

We like the rest of the world relative to the U.S. for the simple reason that the valuations are a lot lower. They also have another significant benefit that has crept in over the last couple of years, which is the U.S. dollar looks quite overvalued versus other currencies around the world. Investing where you have undervalued currencies really helps equity holders.

The yen is, to use a technical term, stupid cheap at these levels. And that is a wonderful tailwind for Japanese companies. The valuations of Japanese stocks, despite a pretty strong 2023, are still fine, and there is a substantial potential for continued fundamental improvement in Japan. And small cap value (GMO Usonian Japan Value Strategy) is dislocated in that market offering potential excess returns.

All in, Japan is a market we like a lot; Europe looks really good too. We like emerging and we like Value everywhere (GMO International Opportunistic Value Strategy).

Download event highlight here.

Yield to worst as of 11/30/2023. Yield to worst is internally calculated as the weighted average yield on the cash bonds over the total market value of the portfolio.

Disclaimer: The views expressed are through the period ending January 4, 2024, and are subject to change at any time based on market and other conditions. This is not an offer or solicitation for the purchase or sale of any security and should not be construed as such. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities.

Copyright © 2024 by GMO LLC.All rights reserved.

Yield to worst as of 11/30/2023. Yield to worst is internally calculated as the weighted average yield on the cash bonds over the total market value of the portfolio.